Understanding Treasury Bond Auction Results – Uganda Edition

By Impala Market Team

Treasury bond auctions may seem technical, but they affect all of us—from interest rates on loans to investment returns and the broader economy. In this post, we break them down using real data from Uganda’s bond auctions in March and April 2025.

Part 1: What Happens in a Treasury Bond Auction?

Every few weeks, the Bank of Uganda (BoU) holds a Treasury bond auction to raise money for government projects. Banks, pension funds, insurance companies, and even individual investors can participate. They submit bids for different bonds, offering an amount they want to invest and the yield (interest rate) they’re asking for.

BoU looks at the bids and picks the most favorable ones (usually the lowest yields for the government). In exchange, investors receive bonds and earn interest over time.

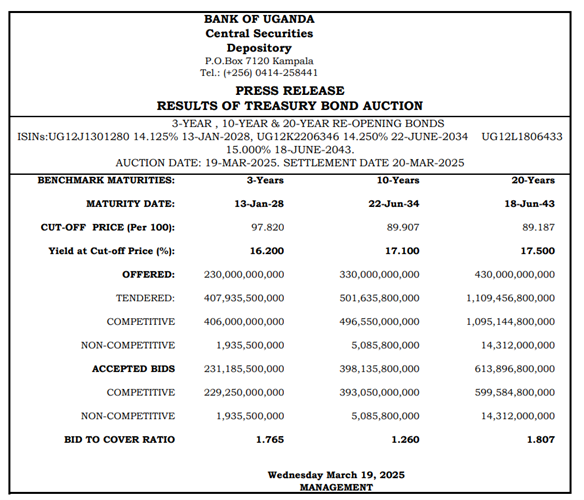

🗓 Real Example: March 19, 2025 Auction

Bonds Offered: 3-year, 10-year, 20-year

Total Offered: UGX 990 billion

Total Bids Received: UGX 2 trillion+

Yields Set At:

3-Year: 16.2%

10-Year: 17.1%

20-Year: 17.5%

This shows strong demand for Uganda’s government bonds, especially for the longer-term 20-year bond.

Part 2: What Do Cut-Off Yields and Prices Mean?

🔹 Cut-Off Yield

This is the highest yield (interest rate) accepted in the auction. If your bid was above this, you didn’t get the bond.

Example: In March, the 3-year bond’s cut-off yield was 16.2%. That’s how much annual return investors will earn on that bond.

🔹 Cut-Off Price

This is what you pay per UGX 100 of the bond's face value. If the cut-off price is below 100, you pay less upfront but still earn full interest.

Example: If the 3-year bond had a cut-off price of 97.82, investors paid UGX 97,820 for every UGX 100,000 bond.

📌 Lower prices = Better deals (as long as you're holding the bond to maturity).

Part 3: What is the Bid-to-Cover Ratio and Why Does It Matter?

This ratio tells us how much demand there was compared to how much was offered.

March 19 BCR:

3-Year: 1.77x

10-Year: 1.26x

20-Year: 1.81x

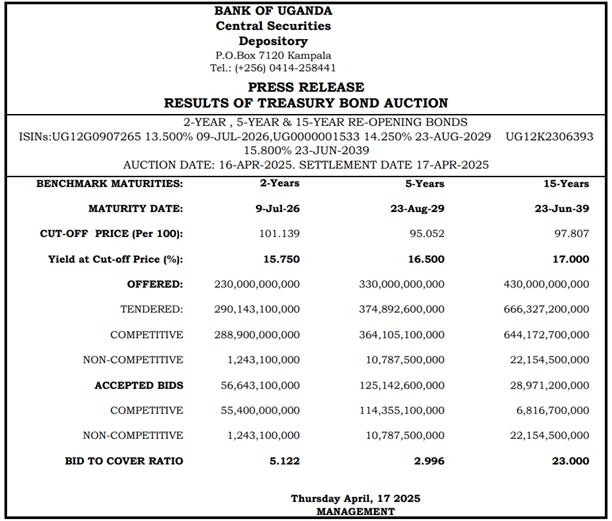

April 16 BCR:

2-Year: 5.12x

5-Year: 2.99x

15-Year: 23.00x 🔥

🧠 Higher ratio = more demand. The 15-year bond in April had overwhelming interest, but BoU only accepted UGX 29B out of UGX 666B offered! That’s called tight supply, and it impacts pricing in the secondary market.

Part 4: Do Bond Yields Affect Loan Interest Rates?

Yes! Government bond yields are a benchmark for interest rates across the economy.

If yields rise:

Banks may increase interest on loans and mortgages

Investors may move money from savings accounts to bonds

If yields fall:

Loan rates may go down

Bonds become more expensive in the secondary market

🧮 March yields: 16.2% – 17.5%

🧮 April yields: 15.75% – 17.00%

Yields are staying high, which means borrowing might remain expensive for now.

Part 5: How Do Auction Results Affect Bond Trading?

After bonds are sold at auction, they can be traded on the secondary market.

If new bond yields go up, older bonds lose value.

If new bond supply is tight (like April), older bonds become more valuable.

April 16 Highlights:

Only UGX 210B was accepted vs UGX 1.33T in bids.

15-Year bond had huge demand but almost no new supply.

This makes older bonds from March (especially 10Y and 20Y) more valuable and tradeable. If you're an investor, this could be your chance to sell at a premium—or hold for high, steady returns.

Part 6: Should You Invest in Treasury Bonds?

Uganda’s Treasury bonds are offering 16%–17% annual returns with low risk—better than most savings accounts or fixed deposits.

✅ Safe investment – backed by government

✅ Better returns than bank savings

✅ Steady income – paid semi-annually

🚧 Things to watch:

You need to hold until maturity (unless you sell early)

Secondary market prices can go up or down

Interest earned is taxable

Bonus: What Does a Flattening or Inverted Yield Curve Mean?

In April, yields on short-term bonds (2Y at 15.75%) were close to long-term ones (15Y at 17%). This is called a flattening curve.

🔍 It can mean:

Investors think inflation or interest rates will fall

Uncertainty about long-term growth

Possible pressure on banks and credit

In some countries, an inverted curve (short-term rates > long-term rates) has predicted recessions. It’s not a guarantee, but it’s worth watching.

We discuss this some more here.

🚀 Conclusion

The March and April bond auctions give us a clear signal:

Investor demand is strong

Yields remain high

Supply is tight, especially for long-term bonds

Secondary market trading will stay active

If you’re saving, investing, or watching interest rates—Treasury bonds are worth understanding.

Want to invest in Africa’s treasury markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments & investment opportunities

Tailored for individual investors, investment clubs, traders & offshore investors

Subscribe for updates on Impala Market