Uganda's 25-Year Treasury Bond, a New Era for Long-Term Capital

The Government of Uganda, through the Bank of Uganda (BoU), has introduced a 25-year Treasury bond in its FY2025/26 auction calendar, marking the longest tenor ever issued in the domestic market. The bond shall first be issued on 06 August 2025. This positions Uganda among a select group of African nations actively developing long-term local currency markets.

It has significant implications for Uganda’s debt strategy, capital formation and infrastructure development.

What Is a 25-Year Treasury Bond?

A 25-year bond is a long-term fixed-income instrument that pays semi-annual interest and returns principal after 25 years. It is targeted at long-term institutional investors, including:

Pension funds (e.g. NSSF Uganda)

Life insurance companies

Infrastructure investors and Development Financing Institutions (DFIs)

These investors seek duration-matched, low-risk assets that align with their long-term liabilities.

“Duration matching is an investment strategy where the timing of cash flows from bonds aligns with the timing of future obligations, helping pension funds and insurers reduce interest rate risk and ensure they can meet long-term payments.”

Why Now?

1. Extending the Yield Curve

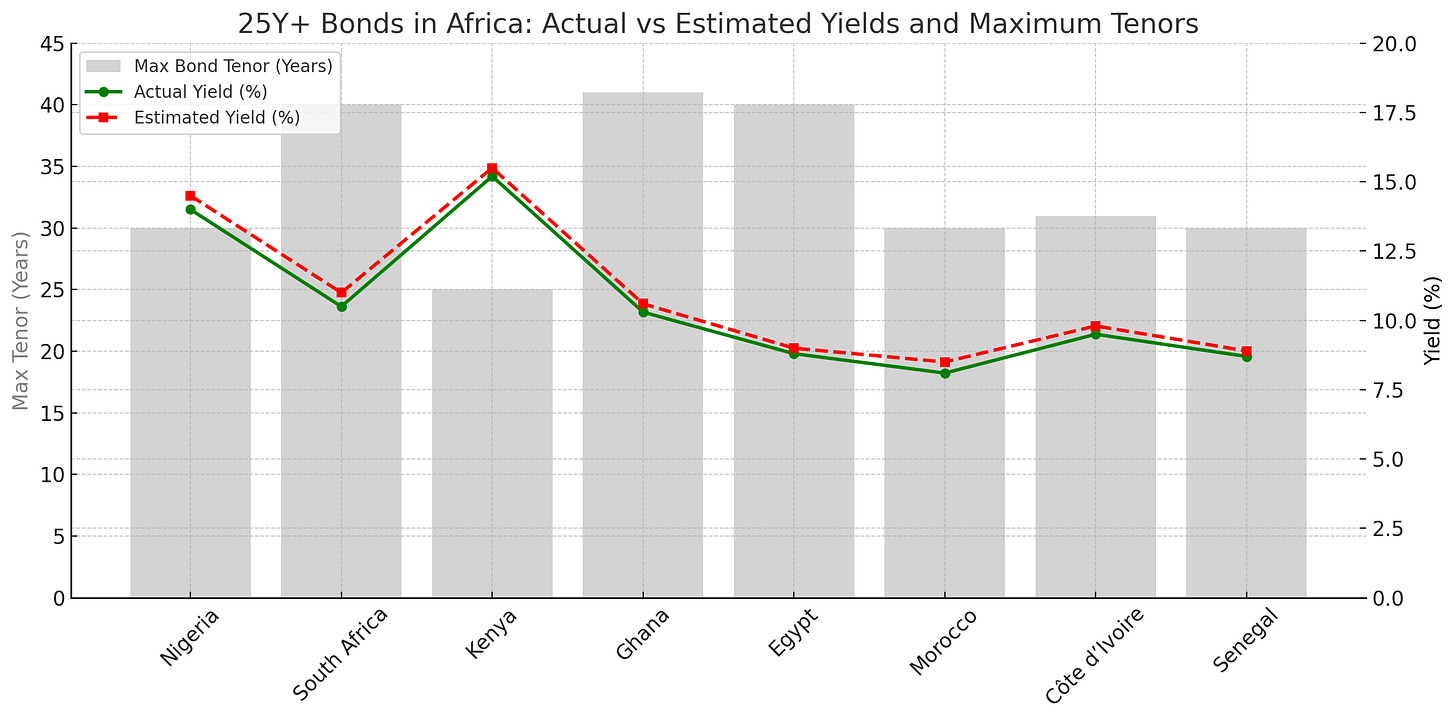

Uganda joins a growing group of African countries issuing ultra-long bonds.

This new 25-year bond helps by:

Providing benchmark rates for pricing long-term projects like housing, infrastructure, and corporate bonds

Allowing investors to model long-term returns using a reliable local reference

Supporting the growth of Uganda’s capital market by extending the yield curve

“A benchmark rate is a standard or baseline interest rate that helps lenders, investors, and borrowers set fair prices.”

2. Unlocking Long-Term Capital

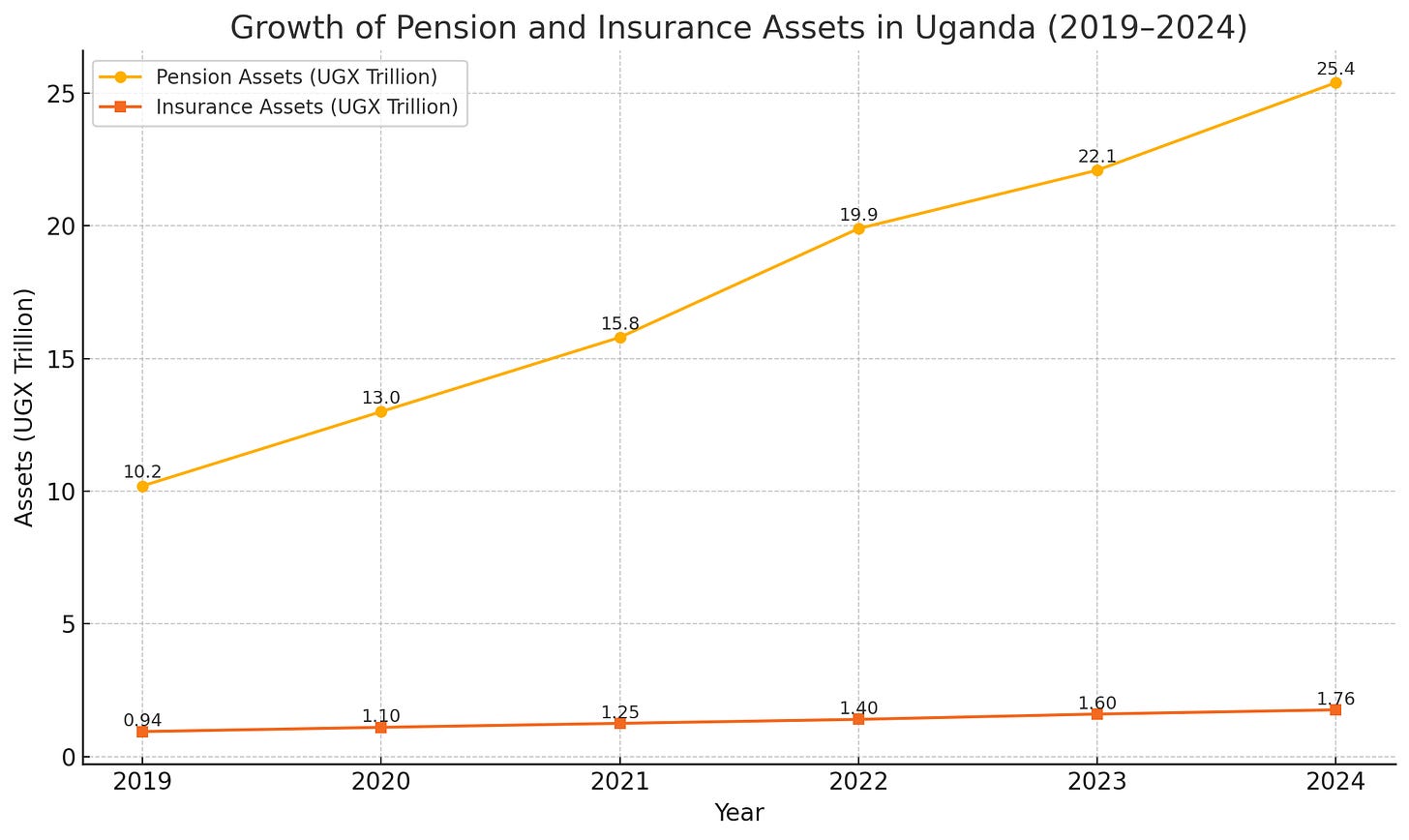

Uganda’s domestic institutional capital pool is growing:

NSSF Uganda now manages UGX 25.4 trillion, with 79% in fixed income

Life insurance premiums hit UGX 701.6 billion in 2024

Regulations require insurance and pension funds to hold significant shares of government securities

The 25-year bond enables:

Alignment of asset and liability duration. For example, a pension fund expects to pay retirees in 20 years. If it invests in a 25-year government bond, the bond’s cash flows match the fund’s future obligations. This is called duration alignment (or duration matching)

Reduced reinvestment risk. For example, an insurance company that invests in a 25-year government bond to match its 25-year annuity payouts locks in today’s interest rate for the entire period. This reduces the risk of having to reinvest in shorter bonds every few years, possibly at lower rates, before the 25 years are up.

Long-term yield certainty. For example, by investing in Uganda’s new 25-year bond at 17.5%, a retirement benefit scheme secures a fixed return for the next 25 years, providing stable, predictable income even if interest rates fall in the future.

3. Signaling Infrastructure Commitment

The 25-year bond gives the government the capacity to:

Finance long-term projects in energy, water, and transport

Uganda Public Investment Plan (PIP) FY2024/25 confirms this focus, with nearly 74% of the UGX 79.78 trillion budget allocated to capital development (infrastructure).

The long-term infrastructure-heavy profile aligns perfectly with ultra-long bond financing, reducing rollover risk and improving budget stability.

Provide sovereign support for Public Private Partnerships (PPPs)

Uganda’s infrastructure PPPs such as roads, power transmission lines, and water supply often require long-term government commitments in the form of availability payments, minimum revenue guarantees, or viability gap funding. The 25-year bond equips government with the ability to honor these obligations over time, signal fiscal credibility to private investors, and lowers the risk premiums demanded by PPP concessionaires. Long-term sovereign benchmarks also help price and structure blended finance solutions, attract development finance institutions (DFIs), and catalyze private capital into infrastructure delivery.

Improve debt sustainability by refinancing shorter, higher-cost obligations requiring frequent rollovers with longer-tenor, lower-risk instruments.

This reduces refinancing pressure, smooths the debt maturity profile, and lowers the risk of liquidity shocks during fiscal stress or election cycles.

Over time, this strategy strengthens Uganda’s debt sustainability by improving cash flow predictability, reducing interest expense volatility, and aligning financing with the lifespan of public assets.

Yield Expectations & Market Dynamics

Uganda’s new 25-year Treasury bond will extend the domestic yield curve into uncharted territory, offering long-term investors a rare duration anchor, but also requiring careful pricing to reflect macroeconomic, liquidity and credit risks.

Expected Yield Range : 16.5% - 18.25%

The bond is expected to price between 16.5% and 18.25%, depending on auction timing, investor sentiment, and macro conditions. This range incorporates:

Challenges to monitor:

Liquidity risk: Low secondary market activity may deter trading

Market capacity: Is there enough demand to absorb long-dated debt?

Fiscal discipline: Will proceeds support refinancing and productive investment?

Impala Market View

The 25-year bond is a bold but necessary step in deepening Uganda’s capital markets. It offers long-term investors a rare duration anchor and provides government with a sustainable tool to finance infrastructure, support PPPs, and improve debt management.

While initial yields may need to compensate for illiquidity and credit risk, strong domestic demand from pensions and insurers should stabilize pricing over time. If structured and communicated well, this bond can become a benchmark instrument unlocking longer-term local currency finance across sectors.

Coming Soon: Uganda’s Updated Yield Curve

Impala Market will publish a fully updated Uganda yield curve, tracking:

Price discovery from the first 25Y auction

Bid-to-cover and investor profile

Peer comparisons across Africa

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.

Now I can understand what the newsletter from my bank says whenever they are giving money market updates