Uganda Treasury Bond Auction Review, 06 August 2025

BoU Draws a Line at the Long End

Executive Summary

The 06 August 2025 Treasury bond auction, featuring a new 25-Year benchmark alongside re-openings of the 2-Year and 15-Year bonds, revealed the Bank of Uganda’s increasingly tactical posture.

The most notable outcome was the deliberate under-allocation on the 25-Year bond, despite overwhelming demand, signaling the central bank’s discomfort with the market's pricing expectations. BoU continues to leverage auction strategy to shape the yield curve, reinforce policy credibility and manage refinancing costs ahead of a potentially turbulent H2 fiscal period.

Auction Results Overview

Notable Observations

The 2-Year tenor was oversubscribed and accepted at slightly above-market levels, a classic liquidity anchor play.

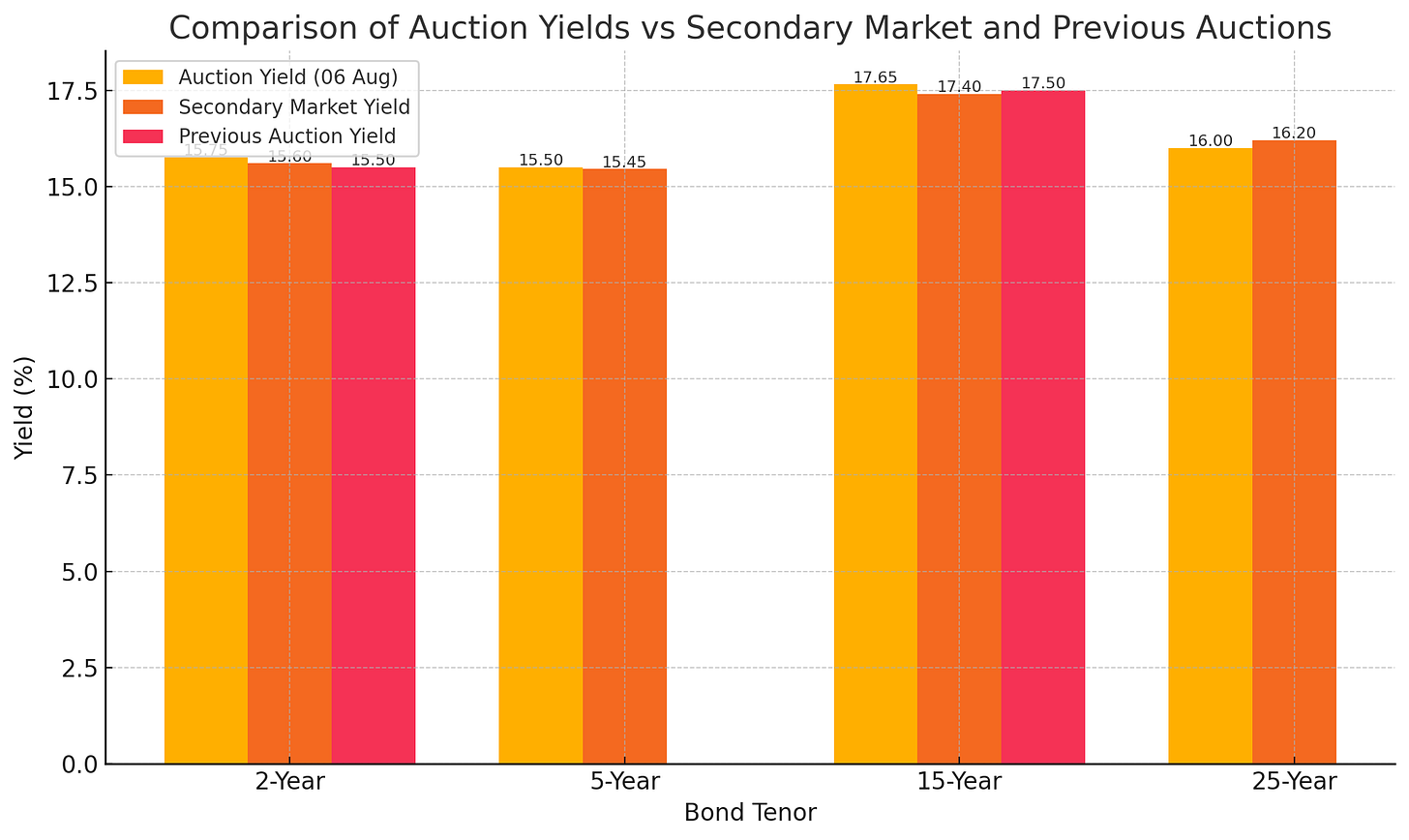

The 15-Year bond saw moderate demand and was cleared at a 17.65% yield, up ~15bps from the last auction, consistent with steepening.

The 25-Year bond saw UGX 745B in bids, but only 11.9B of competitive bids were accepted, with BoU instead opting to fill UGX 45.6B non-competitive.

What’s a “Liquidity Anchor Play”?

When a central bank strategically prices short-term bonds (like the 2-Year) just above market to soak up excess liquidity and guide yield expectations, without letting long-term rates spiral.In this auction, BoU used the 2-Year as a “liquidity anchor”, offering slightly better pricing to encourage participation while maintaining control over the broader curve.

Policy Interpretation: A Curve-Control Strategy in Motion

1. BoU Is Setting a Ceiling

The limited acceptance on the 25Y despite heavy demand signals a line in the sand. The market clearly priced in a higher yield, but BoU refused to validate those levels. Accepting only non-competitive bids helps extend the curve without distorting it.

This is consistent with recent T-Bill behavior, especially the 91-day segment, where BoU has shown reluctance to move short rates aggressively despite strong market bids.

Impala Market Take: BoU is engaged in passive yield curve control - tolerating moderate steepening while avoiding a runaway repricing at the long end.

Auction vs Secondary Market Comparison

The 25Y bond's 16.00% cut-off is visibly below secondary market pricing (~16.20%), supporting the thesis of a managed rollout.

The 15Y bond cleared at a premium, possibly influenced by limited participation or term premia.

Macro Backdrop

BoU’s posture must be read in the context of:

Delayed donor inflows, creating fiscal funding pressure

Heightened reinvestment risk, especially at the short end

Approaching 2026 elections, which may raise long-end risk premiums

A still-anchored Central Bank Rate at 9.75%, though inflation has crept higher (core CPI ~4.1%)

This backdrop explains the steepening pressure, with markets demanding higher compensation for duration and fiscal uncertainty.

Investor Implications

For Asset Managers:

Tread carefully at the long end: While the 25Y bond may appear attractive, secondary liquidity and duration volatility make it more suitable for liability matching institutions (e.g. pension funds).

Front-end & belly remain tradable: The 2–5Y segment offers better risk-adjusted return potential with decent liquidity and tighter pricing bands.

Curve plays are back: With BoU anchoring short rates and allowing long-end steepening, 2s/10s and 2s/15s flatteners may offer tactical opportunity.

For Primary Dealers:

BoU’s acceptance patterns signal that bid discipline will be rewarded. Overpricing to extract risk premium will continue to be met with rejection.

Non-competitive allocations are gaining weight - consider strategic use of this channel in future long-dated auctions.

For Policymakers:

The market is showing up but demanding to be paid.

Fiscal authorities must take note: duration risk is priced, and sustained funding needs may push yields further unless managed with transparency and coordination.

Communication matters: Clear signaling on fiscal plans, especially around Eurobond refinancing and concessional inflows, will lower term premia.

Outlook for August 2025 Auctions

With another round of auctions due on August 21, we expect:

Continued curve steepening, unless BoU intervenes more aggressively

Reinvestment flow rotation from maturing T-bills into mid-belly tenors

Heightened interest in 5–10Y bonds as asset managers look for stable carry amid political and inflation noise

Secondary Market Implications

1. Short and Mid-Curve Activity to Rise

The 2Y and 15Y are now more liquid. Expect higher secondary trading as dealers offload excess allocation and roll positions.

2. 25Y Bond Remains Illiquid

With the bulk allocated to long-hold institutions via non-competitive bids, the 25Y is unlikely to see much OTC activity in the near term.

3. Sentiment Signal: “No to Aggressive Long-End Pricing”

BoU’s rejection of UGX 750B in 25Y bids reflects unease with the market’s demanded risk premium. Long-end traders will be cautious.

4. Positioning Ahead of 21 August Auction

Traders will likely rotate toward the belly (5Y–10Y), where risk-return profiles are more stable. Demand for 25Y exposure may shift to the secondary market, if priced well.

Summary

“BoU is extending the yield curve with a steady hand, not to chase funding, but to shape expectations. The market is liquid and willing, but it's also demanding a premium. The central bank’s selective bid acceptance reveals both discipline and caution in equal measure.”