Uganda Treasury Bill Auction Review: 13 August 2025

What the August 13 auction told us about investor sentiment, yield pressure and what to watch next

Auction Summary

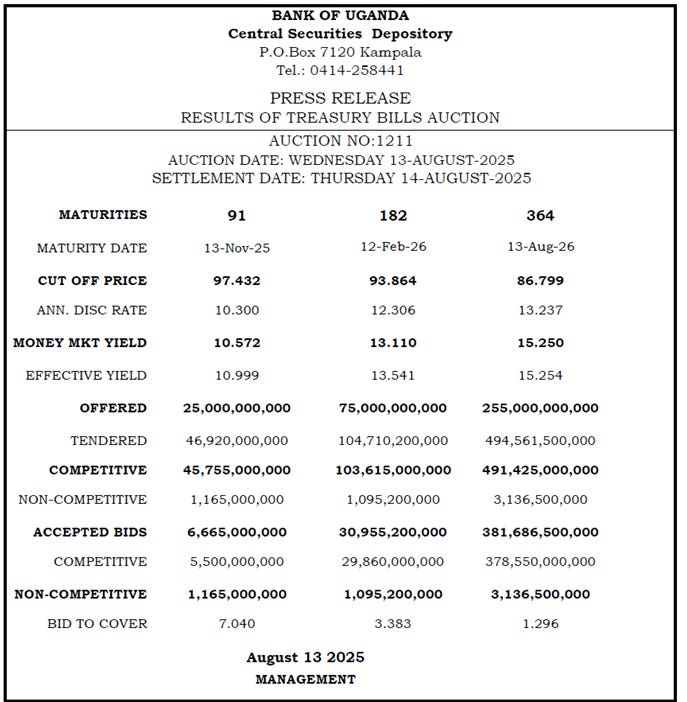

Auction No. 1211 | Date: 13 August 2025

Instruments Offered: 91-day, 182-day, and 364-day T-bills

Total Amount Offered: UGX 355 billion

Source: Bank of Uganda Auction No. 1211

Key Observations

1. Strong Demand for Long-End (364-Day)

The 364-day T-bill continues to be the anchor for investors seeking high yield with moderate liquidity risk.

Bid-to-cover ratio of 1.94 with UGX 494.6B tendered vs UGX 255B offered shows solid institutional interest.

The cut-off yield held at 15.254%, essentially flat from the last auction, showing BoU is holding the line on yield pressures at the long end.

2. Mid-Curve (182-Day) Bids Remain Balanced

Investors remain cautious about reinvestment risk in H2 FY2025/26.

With a yield of 13.237%, the 182-day tenor has become a popular play for balancing yield and duration risk.

Bid-to-cover was slightly lower at 1.40×, showing measured participation.

3. Short-End (91-Day) Cut Sharply

Only UGX 6.67B was accepted out of UGX 46.9B tendered on the 91-day — a small fraction of total bids.

Cut-off yield of 10.999% came in flat, indicating BoU is rejecting attempts to push short-end rates higher.

This mirrors recent patterns in the 2-year bond auctions: the short end is now being actively used by BoU as a liquidity control tool.

Trend Insight: Curve Dynamics Hold

The yield curve remains steep, with the spread between the 91-day and 364-day now over 420 bps.

The curve’s shape indicates that markets expect continued fiscal pressure and are demanding a term premium for holding longer-dated securities.

The curve has not inverted — but the front end is tightly controlled, while the back end remains investor-driven.

So What?

For Investors: The 364-day remains the most rewarding paper, especially for fixed-income portfolios. However, demand for the 182-day tenor suggests cautious positioning against fiscal or political shocks ahead of FY25/26 budget implementation.

For Traders: Short-end volatility could rise if BoU continues under-allocating 91-day paper. Monitor secondary market bids closely.

For Policymakers: The healthy bid-to-cover ratios show there’s still liquidity — but rising yield expectations suggest investor caution is building. The short-end suppression may be sustainable only if inflation and policy credibility hold.

📌 Final Word:

“BoU’s rejection of short-end pressure and steady long-end allocation is a classic curve maintenance play. For now, yields are stable but investor sentiment is quietly watching fiscal policy and reinvestment risks unfold.”

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.