Uganda Treasury Bill Auction Review - 18 June, 2025

Yields Edge Higher Again as BOU Balances Cost and Demand

The Bank of Uganda’s latest Treasury Bill auction (No. 1207) held on 18 June 2025 continued a clear trend: rising yields, strong investor appetite, and a cautious central bank that’s still managing short-term costs.

Despite record demand for the 91-day tenor, BoU accepted only a small portion of bids. Meanwhile, the 1-year (364-day) T-bill remained the workhorse of government short-term funding, with over UGX 414 billion accepted at a higher cut-off yield of 15.65%.

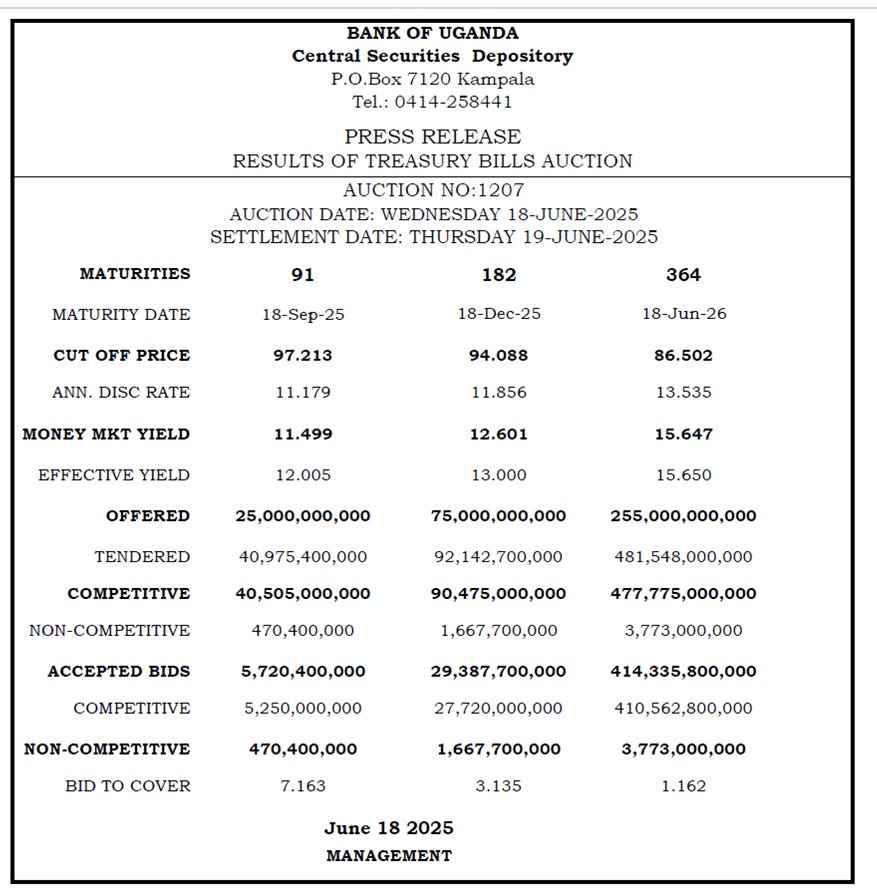

Auction Results, 18 June 2025

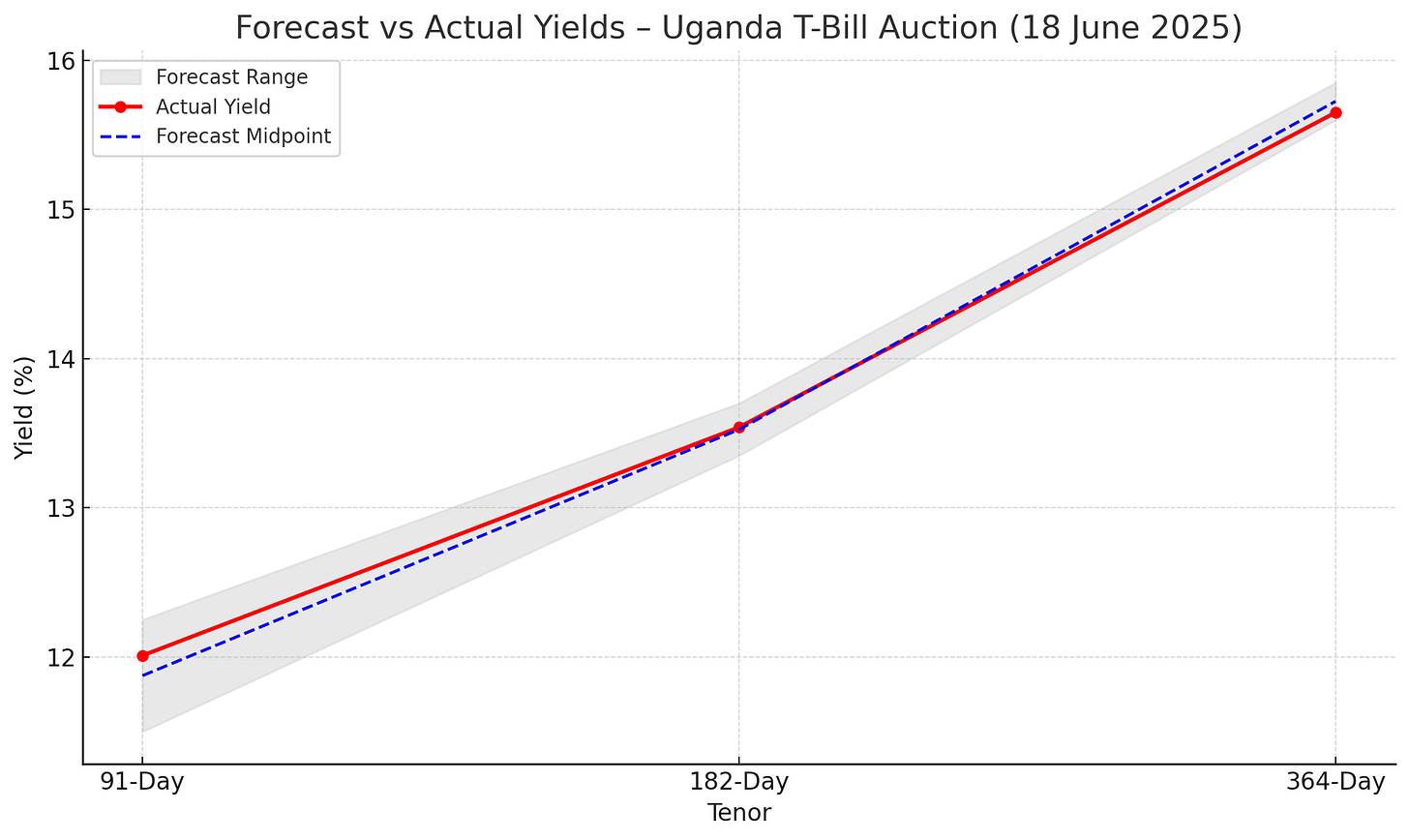

How Did Our Forecasts Compare?

In our previous Impala Market Outlook, we projected yields based on secondary market trends, fiscal signals, and recent auction behavior. Here’s the visual comparison between the forecast range and actual auction yields:

The tight match across all tenors confirms that the current market dynamics are being well-absorbed by investors and accurately priced in.

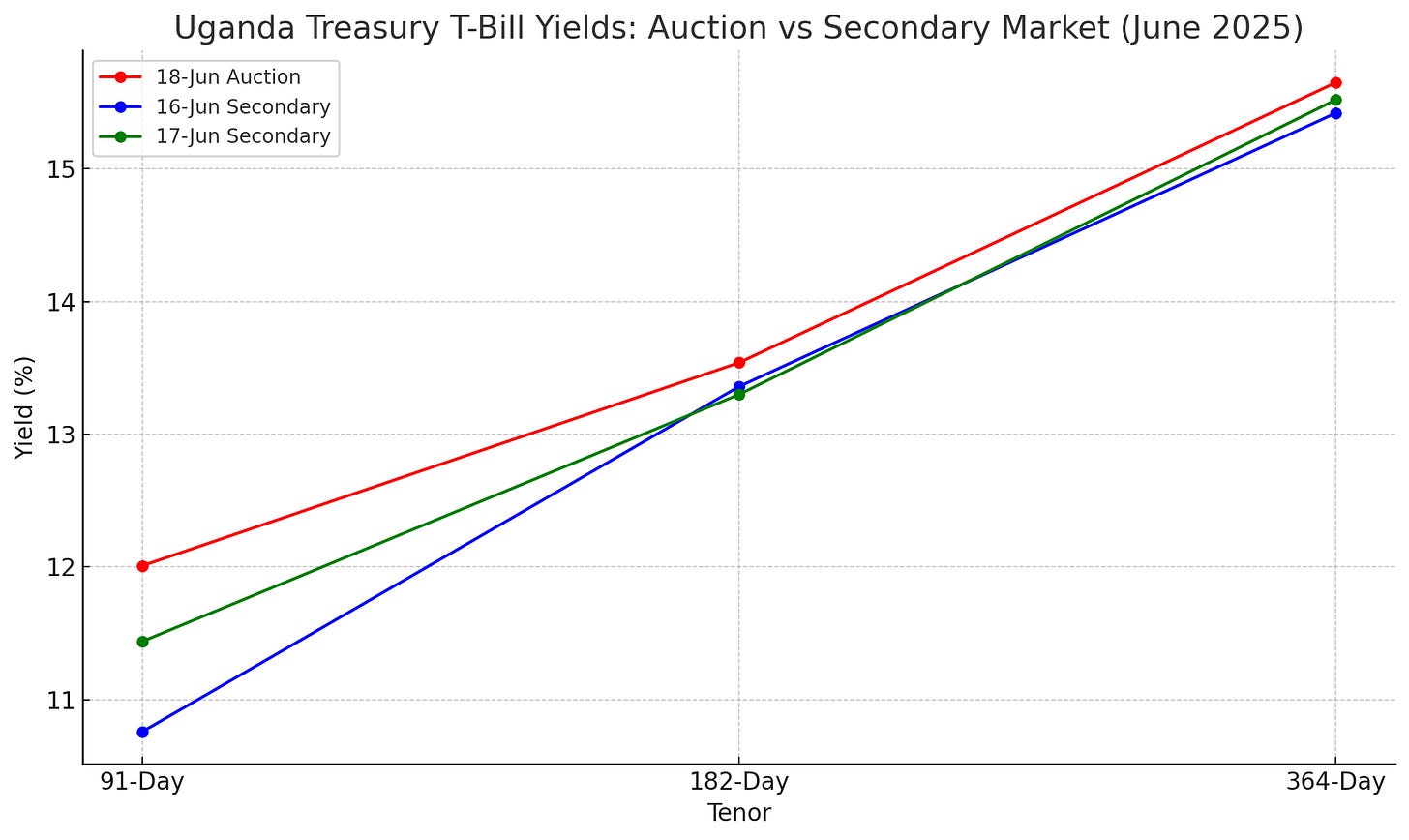

Pre-Auction Signals from the Secondary Market

In the days leading up to the auction (16–17 June), the secondary market was already adjusting for expected tightening, especially on the short end. Here's how those yields compared to the final auction outcome:

Key Takeaways:

The 91-day yield jumped significantly from the secondary market (as low as 10.76%) to an auction-level effective yield of 12.01%, suggesting BoU is now allowing more flexibility after several tight auctions.

182-day and 364-day yields were largely in line with pre-auction trading, confirming that investors had priced the risk accurately.

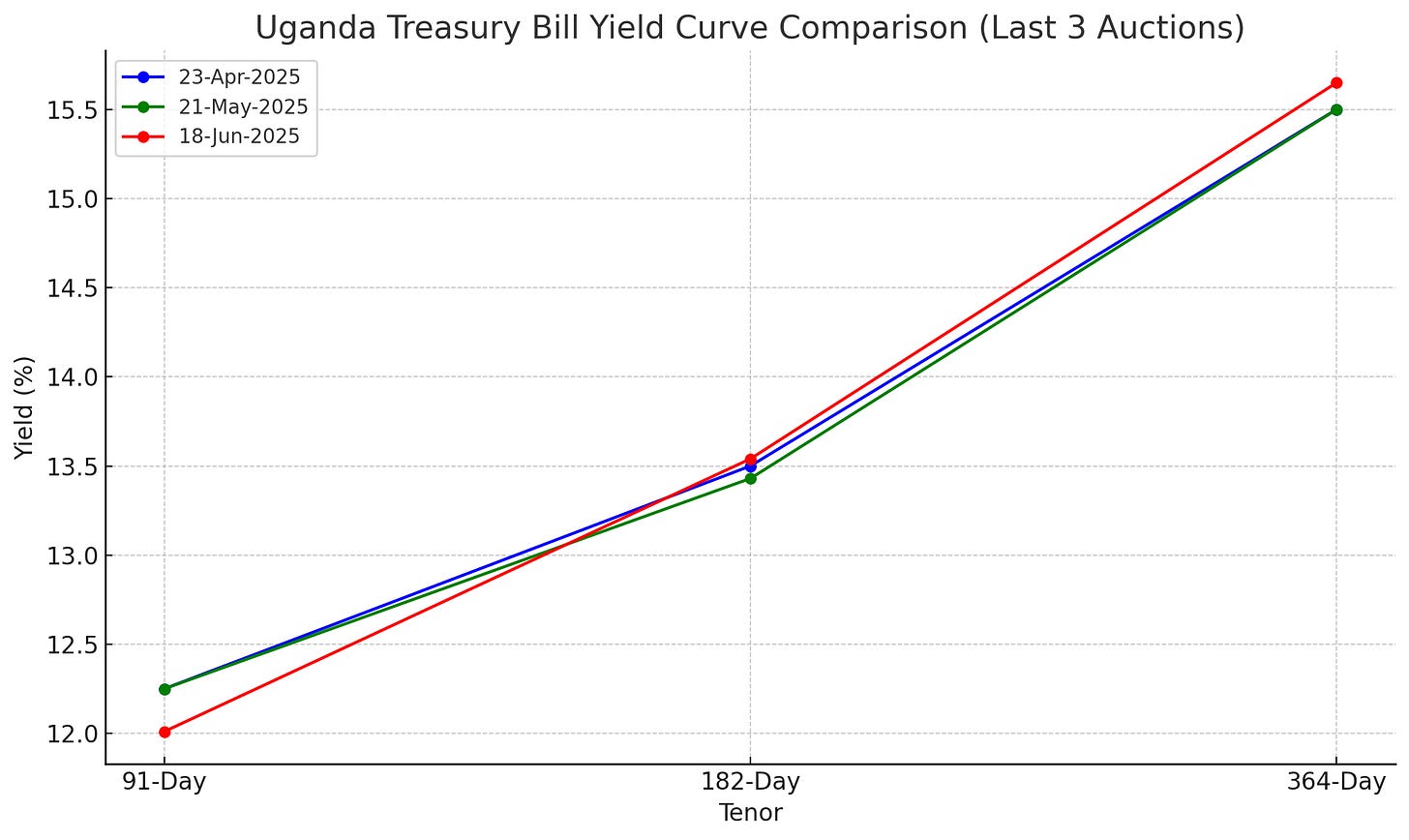

Yield Curve Comparison: Last 3 Auctions

To understand where the market is heading, we compare the past three auction cycles:

This chart confirms a gentle steepening across the curve, especially the mid-point (182-day), which continues to inch upward, likely due to re-investment risk heading into the second half of the fiscal year.

Impala Market Insight

BoU continues to use the 364-day bill as its preferred tool for liquidity management, offering large volumes while maintaining pricing discipline. At the same time, the 91-day bill remains under-issued, creating scarcity and pushing investors toward longer tenors despite rising yields.

This is happening in a backdrop of:

The recent UGX 2.4T private placement, which should have eased immediate funding pressure

The resumption of World Bank lending, which is still in early stages of disbursement

Upcoming fiscal announcements and political considerations in H2 2025

What to Watch in the Next Auction

Will BoU increase its 91-day issuance after three months of rationing?

How much higher will investors push the 182-day tenor before demand weakens?

Could we see a flattening shift if macro funding inflows materialize?

🎯 Impala Strategy View

Short-term investors: The 182-day T-bill now offers good risk-adjusted returns if you want to avoid locking in for 12 months.

Medium-term allocators: The 364-day paper remains attractive above 15.50%, but watch reinvestment risk.

Watch for flattening: If BoU holds yields steady and inflows resume, we may see the curve compress (flatten) in July.

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.