Uganda Treasury Auction Calendar Review, FY 2025/26

Uganda Treasury Auction Calendar Review, FY 2025/26

The Bank of Uganda has released its auction schedule for the fiscal year 2025/26, covering both T-Bills (91, 182, 364-day) and T-Bonds (2–25 year maturities).

The calendar outlines dates for auction and settlement, with a consistent rhythm across quarters.

1) T-Bills (Short-Term Securities)

Auctioned weekly, primarily every Wednesday, with settlement on Thursdays.

Rotating tenor focus: 91-day, 182-day, and 364-day bills appear regularly.

Auctions are marked with an "x", indicating a new T-bill issuance each week.

Observation: This confirms BoU’s intention to maintain weekly short-term market activity, essential for cash management and liquidity planning by financial institutions.

2) T-Bonds (Medium to Long-Term Securities)

Auctioned bi-weekly, alternating with T-Bill-only weeks.

Includes re-openings and occasional new bonds introduced throughout the year.

Focus on 3Y, 5Y, 10Y, 15Y, 20Y and now 25Y bonds for longer-term capital market development.

Observation: A 25-year tenor is now part of the issuance strategy, this will likely support longer-term pension and infrastructure investors.

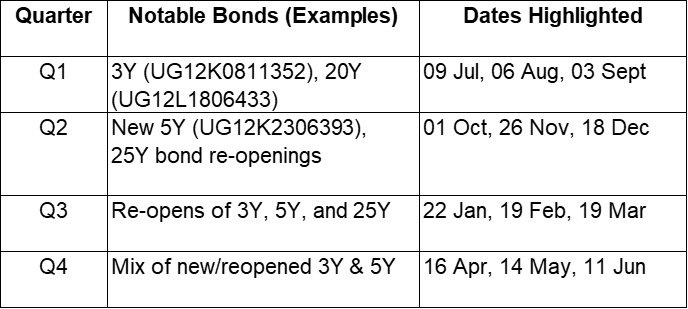

3) Key Bond Auction Trends

4) Takeaways for Investors

Predictable calendar allows for better auction prep, portfolio rotation, and reinvestment planning.

Regular re-openings of key benchmark bonds improve liquidity and depth in the secondary market.

The presence of long-tenor bonds (15Y - 25Y) gives pension funds and long-horizon investors new tools for matching liabilities.

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.