Uganda T-Bill Auction Review – May 21, 2025

By Impala Market Team

Yields Climb Higher as BoU Stays Selective

The Bank of Uganda’s Treasury Bill auction on May 21 (Auction No. 1205) confirmed two things:

Investors are still eager to lend to government at attractive yields

BoU is staying disciplined, accepting only what it needs — and not at any price

Let’s dive into the results and what they tell us about where the market is heading.

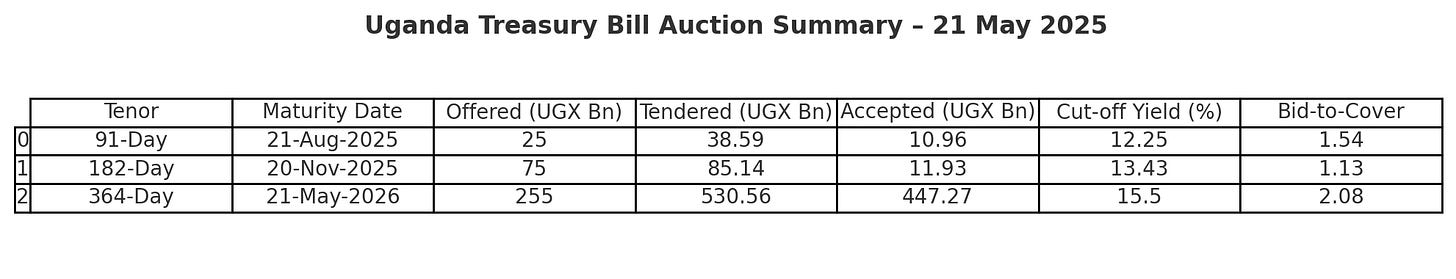

Auction Summary

Key Takeaways

1. The 1-Year T-Bill Is Still King

With over UGX 530 billion in bids and UGX 447 billion accepted, the 364-day T-bill remains the market’s favorite. Its 15.50% yield offers high returns with low risk.

BoU met most of the demand at this tenor — a sign it’s comfortable funding longer and letting the 1-year yield rise slightly (from 15.25% last month).

2. Short-Term Bids Rejected (Again)

Only UGX 10.96B out of 38.59B in 91-day bids were accepted — less than half.

The 182-day also saw limited uptake, with just UGX 11.93B accepted out of UGX 85B.

BoU is clearly being cautious at the short end — either to avoid locking in high short-term borrowing costs or because it has enough short-term liquidity for now.

Yields Are Trending Up

Here’s how yields moved compared to the previous auction on April 23:

While the 91-day rate held steady, the longer two tenors climbed, another signal that the market is demanding more compensation to lend longer in an uncertain environment.

Yield Curve Snapshot

Here’s what the yield curve looks like now vs last month:

🟡 April: smooth and rising

🟢 May: still steep, but now steeper at the long end

This shows that the cost of borrowing is rising for the government, especially on anything beyond 3 months.

Impala Market Insight

The BoU continues to walk a tightrope: accepting enough to fund government operations, but not so much that it spikes interest rates.

The steep curve suggests that investors expect rates to stay high or even rise slightly - either due to inflation concerns or tighter liquidity.

For businesses and investors, 1-year T-bills are still one of the most attractive instruments in Uganda's financial market right now.

What This Means for You

For Businesses:

Loan rates will remain high

Working capital borrowing is likely to stay expensive

Consider 1-year bills for cash reserves

For Investors:

The 1-year T-bill offers strong risk-adjusted returns

The 6-month tenor may be worth watching if yields continue to rise

For Policymakers:

Expect more pressure on short-end demand if liquidity tightens further

Maintaining this balance will be key to market confidence

Stay tuned as we track the next auction and report on the secondary market response.

OTC Desk Call to Action

Traders, Dealers & Investors

Post your bond runs and trade interests on Impala Market. Let’s improve price discovery and deepen secondary market participation.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.