📊 Uganda T-Bill Auction Results – April 23, 2025: What We Expected vs. What Actually Happened

By Impala Market Team

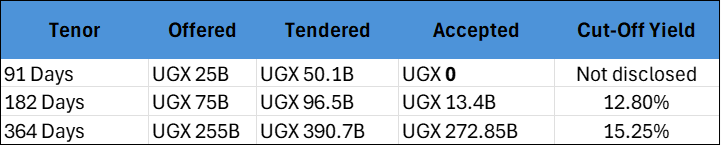

This week’s Treasury Bill auction, Auction No. 1203, by the Bank of Uganda (BoU) left us with some surprises—most notably, a complete rejection of all 91-day bids!

Here’s a breakdown of what happened, and how it compared to our Impala Market preview for the 23 April BoU auction.

Quick Recap of the Offering

What Impala Market Expected (vs. What Happened)

91-Day T-Bill

Expected: High demand (2.5x–4.0x BCR), cut-off yield between 12.00% – 12.75%.

Actual: UGX 50.1B tendered (demand was there), but BoU accepted 0.

Interpretation: The Bank likely viewed the pricing as too aggressive. Investors were probably asking for higher yields than BoU wanted to lock in for short-term money.

🔁 Surprise Level: HIGH

This is rare and sends a strong signal: BoU is in no rush to borrow short-term, and may be trying to control front-end rate expectations.

182-Day T-Bill

Expected: Moderate demand (2.0x–3.0x BCR), cut-off yield around 13.00% – 13.85%.

Actual: UGX 96.5B bid, but BoU accepted only UGX 13.4B. Cut-off yield was 12.80%.

Interpretation: Demand was solid, but BoU stayed disciplined on pricing—possibly aiming to hold the yield curve steady.

🔁 Surprise Level: MODERATE

BoU took a cautious approach, but the very low acceptance was notable. This may point to tighter liquidity management or muted funding needs.

364-Day T-Bill

Expected: Strong demand (1.8x–2.5x BCR), cut-off yield between 15.00% – 15.90%.

Actual: UGX 390.7B tendered (very strong), UGX 272.85B accepted (above target). Cut-off yield came in at 15.254%.

Interpretation: This segment played out as expected. BoU met strong demand with slightly higher-than-offer acceptance, reinforcing confidence in the 1-year benchmark.

🔁 Surprise Level: LOW

As predicted, the 1-year paper was the anchor of the auction. It remains the preferred maturity for both BoU and investors.

What This Means for the Market

🔹 BoU is Managing Expectations

Rejecting all 91-day bids was a powerful move—BoU may be trying to signal that it won’t chase short-term yields upward, and that it’s comfortable with current liquidity levels.

🔹 Yield Curve Anchored at 1 Year

At 15.254%, the 1-year cut-off yield continues to be the main reference point for secondary market pricing. Traders will use this level to recalibrate older holdings and bid strategy in upcoming auctions.

🔹 Short-Term Paper is Now Scarce

With zero new 91-day issuance, prices of existing short-dated paper may rise. Short-term investors may have to look to the secondary market and accept tighter spreads.

Final Word

This auction reinforces BoU’s preference for longer-term funding and careful yield management.

While the 1-year paper continues to offer attractive returns and liquidity, short-term traders should brace for tight supply and more aggressive pricing behavior in the weeks ahead.

📥 Missed our previous market commentary? 👉 Read: What Happened in the April 16 Bond Auction

To get an overview of the market 👉 Uganda Sovereign Bond Market Overview

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market