Uganda Sovereign Debt Market Overview – 2025 Edition

By Impala Market Team

📌 Executive Snapshot

Total Public Debt: UGX 96.2 trillion (~USD 25.5 billion)

Debt-to-GDP Ratio: ~48.2%

Debt Split: ~61% domestic vs. ~39% external

Outlook: Uganda’s local debt market is expanding in response to constrained external financing conditions. There's growing appetite for long-term maturities and greater focus on transparency and accessibility.

🔍 1. Debt Market Structure

Total Public Debt Profile (Q1 2025)

Domestic: UGX 58.7 trillion

External: UGX 37.5 trillion

Debt Service-to-Revenue: Over 40% in FY 2023/24

Governance & Framework

Debt Management: MoFPED’s Debt Management Unit (DMU)

Issuance/Auction Manager: Bank of Uganda (BoU)

Legal Framework: Public Finance Management Act (2015)

📎 Key Links:

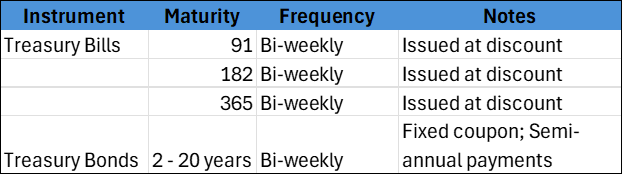

🏦 2. Domestic Debt Instruments

Retail Access expanding via brokers and fintech

Secondary Market remains OTC, with pricing via BoU and primary dealers

🌍 3. External Debt

Multilateral: World Bank (IDA), IMF, AfDB

Bilateral: China Exim, JICA, Saudi Fund

Eurobonds: Not yet issued

Green/ESG Instruments: Being explored under Uganda’s Climate Finance Strategy

👥 4. Investor Base

Domestic Holders

Commercial Banks

NSSF

Insurance Companies

Pension/Asset Managers

Foreign Participation

Free currency and capital flows, however, restricted by currency risk and FX liquidity

Investors must register with BoU and trade via local custodians

🔁 5. Secondary and OTC Market

OTC trades dominate activity

Settlement via BoU Central Securities Depository (CSD)

Yields published biweekly: BoU Yield Curve

Trading: Broker-dealer networks, no dedicated bond exchange yet.

Uganda is exploring sovereign bond trading through the Uganda Securities Exchange (USE) and AltX. USE is a locally recognized entity to issue ISINs by the Association of National Numbering Agencies (ANNA). ALTX is an exchange where secondary market trading of depository receipts, underlined by bonds, has been ongoing for the last 8+ years.

📊 6. Recent Trends

1-Year T-Bills: Now yield 18–20% (Q1 2025)

📈 Driven by:

BoU policy rate hike to 10.75% (March 2025)

Persistent core inflation

Domestic borrowing pressures

Longer tenor bonds favored (10–15 years)

Digital and mobile retail participation on the rise

⚠️ 7. Risk Assessment

Sustainability: Moderate risk (IMF/World Bank DSA)

Risks: Currency depreciation, interest rate volatility, fiscal deficits

FX Exposure: High, with exposure to USD, EUR, JPY, and CNY

✅ 8. Opportunities & Reforms

Develop green bonds and diaspora bonds

Launch a digital bond trading platform via USE or private fintech platforms like AltX

Enhance auction transparency & retail access

Expand mobile-based investment participation

Align public debt strategy with SDGs and climate resilience

9. Annexes

📆 Auction Calendar: Biweekly (Wednesdays)

🔐 Credit Ratings:

Moody’s: B3 (Negative)

S&P: B- (Stable)

🧰 Key Data Sources:

📬 For Investors & Researchers

Uganda’s sovereign debt market is maturing with credible returns for local currency investors, especially amid global tightening. With improving systems and fintech access, Uganda remains a frontier market to watch.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market