09 July 2025 Uganda Treasury Bond Auction Update

TL;DR Investors return strongly to the long end, but rising yields show the market is demanding more.

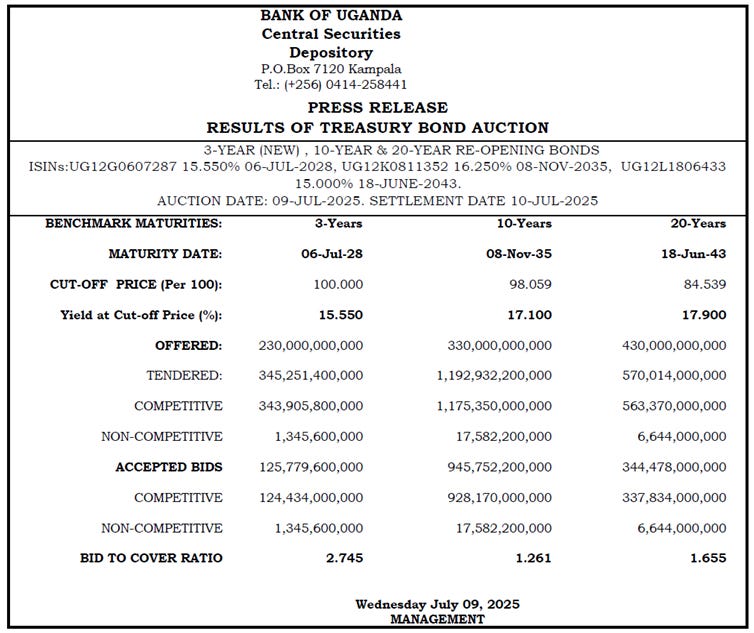

Auction Summary

The Bank of Uganda held a successful Treasury Bond auction on Wednesday, 09 July 2025, issuing UGX 990 billion across 3-year, 10-year, and 20-year maturities. Despite the uptick in yields across all tenors, investor appetite remained strong, with a total of UGX 2.1 trillion in bids tendered.

Note: The 3-year bond was a new benchmark issuance. The 10-year and 20-year tenors were re-openings of existing bonds.

Key Takeaways

1. Yields Climb Across the Curve

The auction marked a notable rise in yields across all three maturities:

+50 bps on the 3-year (vs previous June auction)

+20 bps on the 10-year

+40 bps on the 20-year

The rise reflects growing risk premiums driven by reinvestment uncertainty, fiscal strain, and cautious investor positioning ahead of H2 2025.

2. Strong Demand at the Long End

Despite the yield increase, bid-to-cover ratios remained solid, particularly for the 3-year (2.75x) and 20-year (1.66x).

The 10-year was the least subscribed, suggesting slight fatigue or preference for either shorter or much longer duration.

3. Secondary Market Reflects the Shift

On the same day (9 July), secondary trading showed:

13.5% July 2026 (3-year) trading at 15.23% YTM, confirming higher short-term pricing.

15.0% 2043 (20-year) bonds traded up to 17.85–18.60%, showing alignment with primary auction pricing.

Secondary trades on 8–9 July reflected rising yields and investors adjusting pricing expectations even before auction settlement.

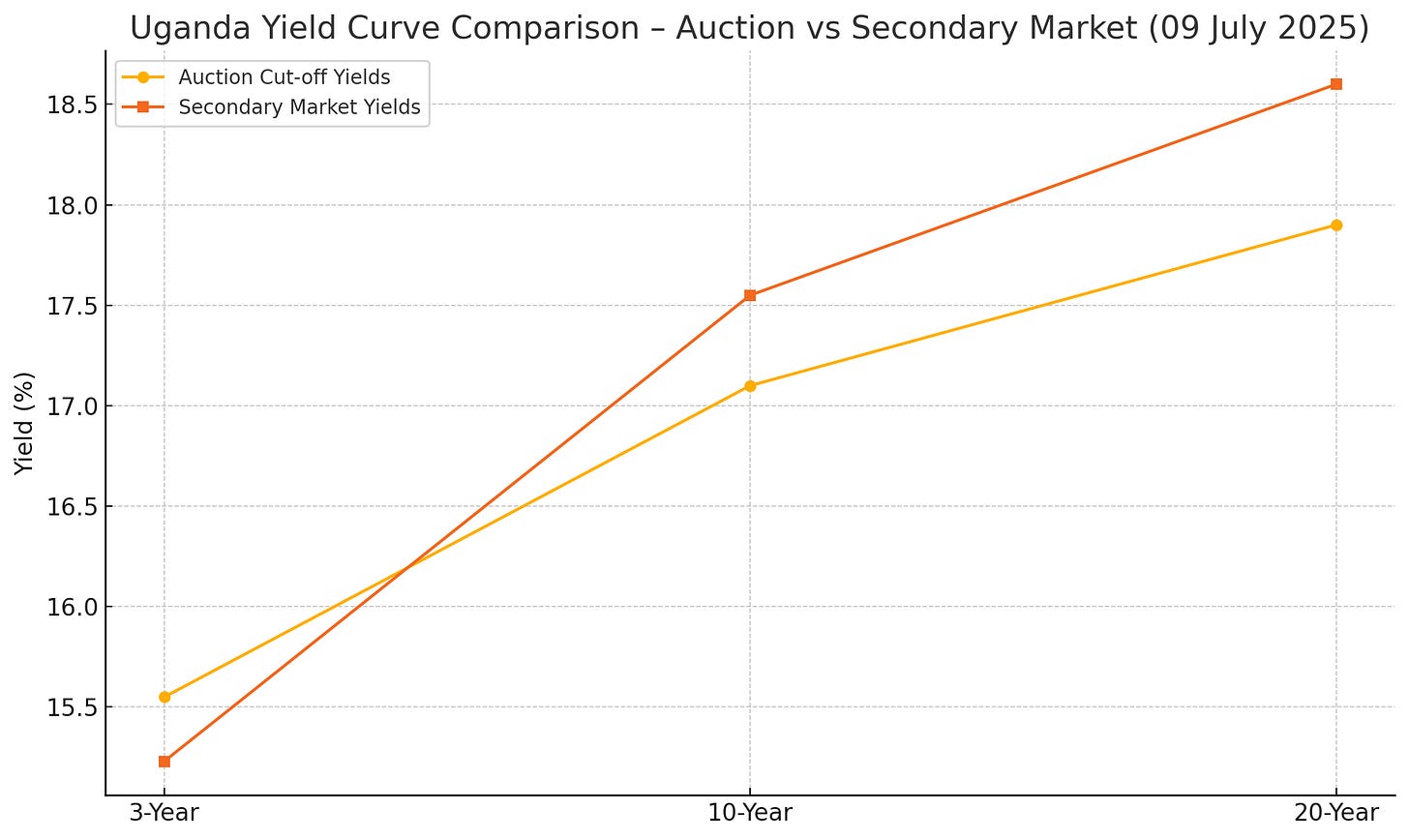

Yield Curve

We compared the auction cut-off yields to secondary market yields for 09 July. The chart shows a steepening curve, especially between 3 and 10 years, suggesting rising risk premiums and term structure re-pricing.

This chart shows a clear gap between auction cut-off yields and secondary market pricing:

3-Year: Auction yield slightly above market (15.55% vs 15.23%) — a sign of strong short-end demand.

10-Year: Market priced higher (17.55%) than auction (17.10%), pointing to growing medium-term caution.

20-Year: Largest divergence (18.60% vs 17.90%) — investors want a premium for long-term risk.

Key Insight: The curve is steepening in the secondary market, even after a well-subscribed auction. This reflects persistent risk pricing, especially on duration and liquidity.

What It Means for Investors

Lock in high yields now: Investors confident in Uganda’s medium-term fiscal direction may see value in long-term positions with 17–18% locked-in yields.

Curve steepening suggests positioning matters: Short tenors offer liquidity; long tenors offer premium — but at a price.

Be cautious of fiscal and liquidity signals: If upcoming auctions continue to clear at higher yields, we may see a spillover into commercial lending rates and broader market repricing.

Final Word

The July 9 auction reinforces a key market message: liquidity is still available, but investors want to get paid for holding risk. With fiscal pressures, global rate uncertainty and domestic political noise on the horizon, yields may stay elevated unless the macro backdrop improves.

Want more clarity on how these yields affect your portfolio or savings decisions. Subscribe to Impala Market for weekly insights and investor tools.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.