Uganda Bond Market Update – Treasury Bond Auction, 14 May 2025

By Impala Market Team

Uganda’s government securities market continues to attract strong investor demand, as seen in the May 14 Treasury Bond auction. However, the central bank remains cautious on how much it accepts and what price (yield) it’s willing to pay.

In this edition, we review:

Results from the 14 May bond auction (3Y, 10Y, 20Y)

Secondary market reactions

Latest Treasury Bill market trends

A simple yield curve comparison to tie it all together

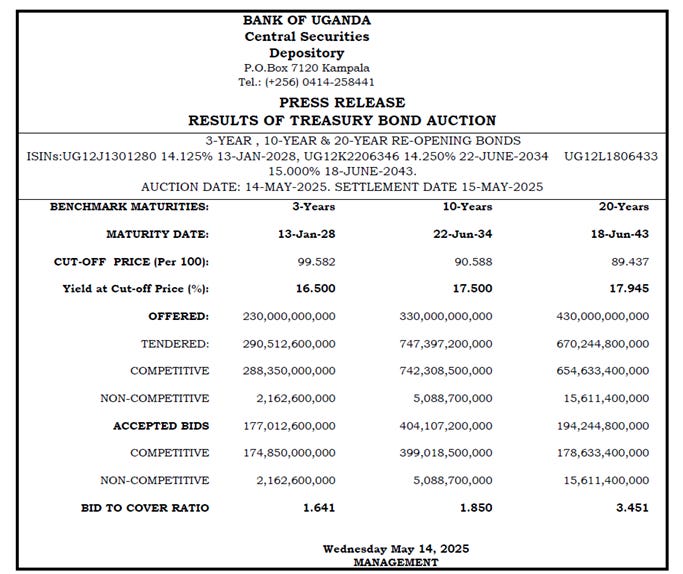

Treasury Bond Auction Summary – 14 May 2025

The Bank of Uganda reopened 3-year, 10-year, and 20-year bonds. Here’s what happened:

Key Takeaway: Demand was strong, especially for the 20-year bond but BoU was selective in what it accepted.

Secondary Market Reaction (13–15 May)

10Y and 20Y bonds were actively traded before and after the auction.

Post-auction, yields inched higher:

2043s traded at ~17.80–17.95%

2034s hovered near 17.40–17.50%

Turnover on 14 May exceeded UGX 387B, with heavy flows in long-dated paper.

Impala Insight: Investors may have offloaded excess auction allocations or adjusted portfolios after settlement.

Treasury Bill Market Update

In the most recent T-bill auction (Auction No. 1203 – April 23), BoU:

Rejected all bids on the 91-day paper

Accepted only UGX 13.4B on the 182-day tenor

Took UGX 272.85B on the 364-day paper at 15.254%

What this tells us:

BoU is avoiding short-term borrowing at high rates

1-year T-bills remain the preferred vehicle for both funding and investing

The short-end of the curve is tight — investors may need to look to the secondary market for supply

Yield Curve Comparison

Here’s how the auction yields on 14 May compared to average secondary market yields just before and after:

Auction yields were slightly higher across the curve, showing BoU’s willingness to accept a premium to meet fiscal targets.

Secondary market yields reflect investor expectations and trading behavior.

Impala Market Commentary

BoU is maintaining a tight grip on rate direction while letting the market clear where necessary.

The bond curve continues to steepen, but demand at the long-end shows confidence in macro stability.

The next T-bill and bond auctions will likely show whether this trend holds, especially if inflationary pressures or fiscal issuance ramps up.

Want more clarity on how these yields affect your portfolio or savings decisions. Subscribe to Impala Market for weekly insights and investor tools.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.