Uganda Bond Market Update – Auction Review & Positioning for August 7

1. Treasury Bill Auction Recap – 30 July 2025

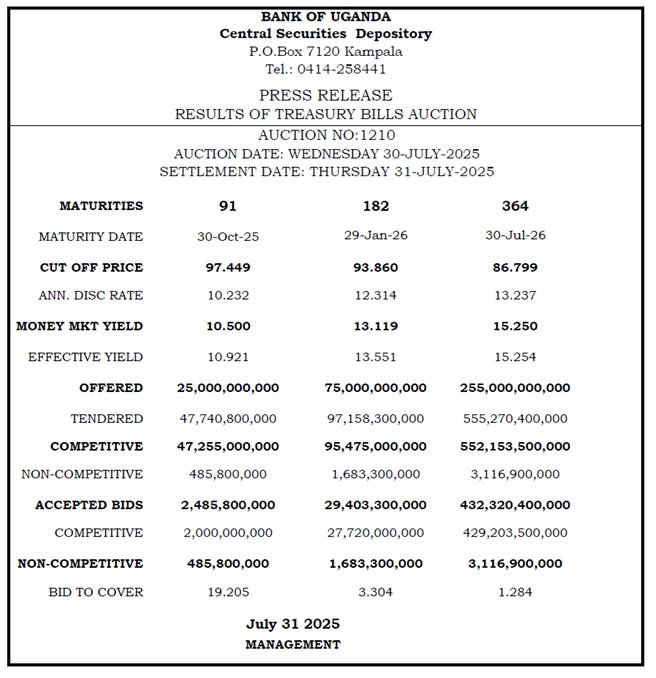

Uganda’s Treasury Bill auction (No. 1210) held on Wednesday, July 30 gave us some key signals on short-term investor sentiment.

Auction Snapshot

What the Results Tell Us

91-Day T-Bill:

A very high bid-to-cover ratio (19.2x), but BoU only accepted UGX 2.5B out of UGX 47.7B tendered.

Signal: The BoU is likely managing supply tightly on the short end to discourage excess liquidity churn.182-Day T-Bill:

Steady demand and accepted bids suggest this is becoming a “sweet spot” for cash managers balancing yield and reinvestment risk.364-Day T-Bill:

Weak bid-to-cover (1.28x) and full take-up of competitive bids shows investors are demanding more yield for locking in over the medium term. The 15.25% yield could anchor pricing expectations for the upcoming bond auction.

2. What to Expect – Treasury Bond Auction on August 7, 2025

BoU is coming back with UGX 1.1 trillion in Treasury bonds, including a historic first 25-Year bond.

Here’s what’s on offer:

Strategic Positioning: What to Watch

25-Year Bond (UGX 500B) – Market Landmark

First ever 25Y bond, highly anticipated.

Offers 17.0% coupon, the highest on the curve.

Likely to attract pension funds (e.g. NSSF) and insurance firms.

Expect some duration premium to be built into cut-off yields (possibly 17.3–17.5%).

What’s a Duration Premium?

Investors demand higher yields for holding longer-term bonds due to greater uncertainty over interest rates, inflation, and liquidity. In Uganda, the new 25-year bond will likely carry a duration premium above the 15- and 20-year benchmarks, reflecting market caution about locking up capital for the long haul.

5-Year Bond – Mid-Curve Compass

New issuance fills a key tenor gap.

Yields may settle around 16.3–16.7%, pricing in inflation and fiscal risks.

Demand could be tactical with banks and funds seeking relative value.

2-Year & 15-Year Re-openings

Familiar papers, useful for curve maintenance.

2-Year could see demand from risk-averse bidders.

15-Year already widely held, could see moderate follow-on interest.

“By reopening the 2-year and 15-year bonds, BoU is maintaining key curve points to support price discovery, liquidity, and investor confidence — especially as it integrates the new 25-year benchmark.”

Market Context & Macro Backdrop

BoU has kept policy rates stable, but yield drift in T-bills shows risk premiums are rising.

Donor funding has resumed, but cashflow execution may take time.

Pre-election uncertainty and fiscal overhang will weigh on investor confidence in H2 2025/26.

📌 Final Thoughts: What This Means

The 25-Year issuance is a milestone for Uganda’s domestic debt market. It tests appetite for ultra-long duration and builds credibility in the local curve.

Auction dynamics will signal how far investors are willing to go to absorb risk in exchange for yield.

Expect price discovery across the curve, especially for 5Y and 25Y tenors.

Traders, analysts, and portfolio managers should prepare for a more volatile bond market as issuance ramps up and investors digest new supply.

Next Steps

We’ll be covering auction results and secondary market reactions after August 7.

Subscribe for the next edition: blog.impala.market

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.