Repricing Risk: Tracking Uganda’s 182-Day Treasury Bill Through H1 2025

Uganda’s 182-day Treasury bill yield has steadily climbed from early 2023 through mid-2025, revealing more than just auction results, it reflects a shift in investor sentiment, macro expectations, and political risk pricing. For fixed income investors, this mid-tenor is fast becoming the most telling signal on the yield curve.

From Suppressed to Steady: How We Got Here

In late 2023 and early 2024, 182-day T-bill yields hovered around 11.7% - 12.1%, reflecting:

Tight supply management by BoU

Low domestic borrowing needs at the time

Donor funding delays, which constrained auction activity

As 2025 unfolded, auction volumes increased and investor caution grew. Since January, yields have risen more than 40 basis points, driven by reinvestment risk and macro uncertainty.

Why Were Yields Suppressed in Late 2023?

Uganda experienced delays in donor funding from partners like the World Bank and IMF. To manage fiscal pressure without driving up borrowing costs, the Bank of Uganda: 1) Cut back on auction volumes; 2) Rejected aggressive bids; and 3) Temporarily delayed new issuance. This constrained supply helped hold yields down, even as inflation and liquidity risks quietly mounted.

The Verified Yield Trend

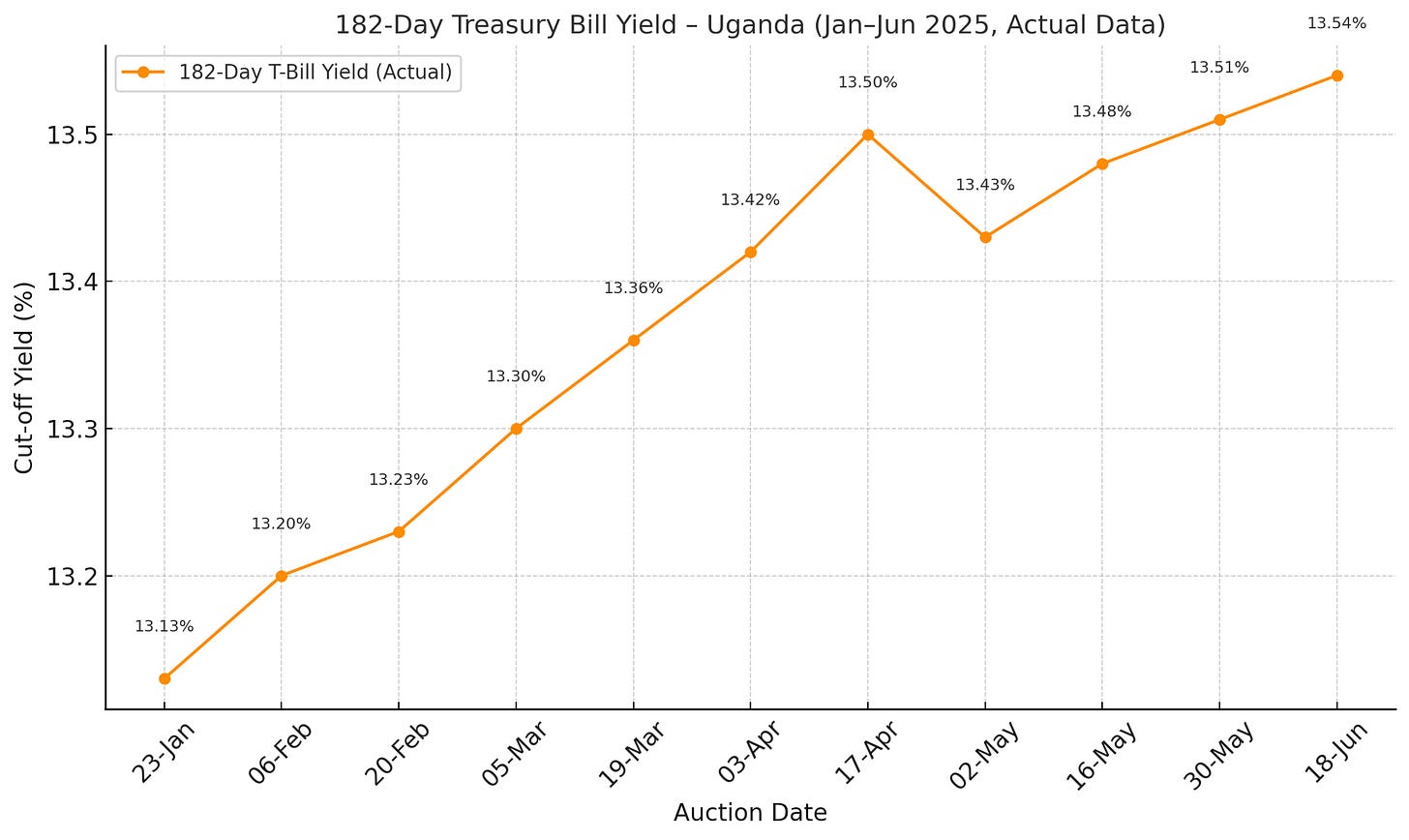

Here’s the actual cut-off yield progression for the 182-day T-bill from January to June 2025.

What’s Driving the Mid-Tenor?

1. Reinvestment Risk Premium

Investors are increasingly unwilling to take short-duration paper without a premium. With expectations that yields might rise (or inflation might surprise), the 182-day tenor offers tactical flexibility.

2. Fiscal Spending Uncertainty in H2

With Uganda’s FY2025/26 budget execution starting in July and donor inflows still staggered, domestic issuance could increase. Investors are pricing in this funding risk without locking up for a full year.

3. Pre-Election Liquidity Fears

Historical patterns show that election years (like 2026) are preceded by looser fiscal policy. The 182-day T-bill will mature into Q4 2025, a window that may see elevated government spending. Smart money wants to be compensated.

So What Does This Mean for You as an Investor?

Whether you're managing a treasury book, investing for income, or positioning ahead of the 2026 elections - here’s what this yield trend is telling you:

For Fixed Income Managers:

The 182-day bill is now a tactical duration anchor. It offers visibility into the next fiscal window (Jul–Dec 2025) without the full 12-month commitment.

Rising yields = better entry points. If you’re holding excess liquidity, this is where the risk-return profile is most favorable.

If you believe BoU will cap yields ahead of concessional inflows, this may be your last opportunity to lock in 13.5%+ before flattening.

For Institutional Allocators:

Use the mid-tenor as a liquidity parking tool while longer-term bond yields remain volatile.

Don’t ignore the steepening trend, it signals expectations of elevated short-term fiscal pressure.

For Corporates and Treasurers:

T-bill yields are a signal for where borrowing costs may go.

If 182-day rates stay above 13.5%, expect pressure on bank loan pricing, especially for working capital lines.

Consider matching short-term liabilities with mid-tenor bills for natural hedging.

For Retail and High Net-Worth Investors:

If you’re using T-bills as a savings product, this may be a window to lock in attractive passive returns.

The 182-day tenor is liquid enough to sell on the secondary market but still offers better interest than 91-day and less reinvestment stress.

📌 Final Takeaway

Uganda’s mid-tenor is doing what mid-tenors do best: showing investor caution, rate transition sentiment, and liquidity preferences.

As a fixed income investor, watching the 182-day yield is your early warning system for both macro conditions and tactical opportunity.

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.