Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 09 May 2025)

By Impala Market Team

🔄 Review vs Forecast: What We Got Right

Last week's market activity confirmed expectations from our prior outlook:

📅 Weekly Overview

Despite a quiet week on the primary auction calendar, Uganda's secondary market was active and deep, with turnover exceeding UGX 363 billion on Friday alone.

Investor flows remained concentrated in:

Medium-tenor zero-coupon bonds (2025–2026)

Long-end benchmark bonds (2039 and 2043 maturities)

High-yielding corporate-like exposures including 16.375% 2032 and 18.5% 2042 paper.

There was sustained demand for 13.5% 09-Jul-2026, trading around YTM 15.50% to 16.50%, and a strong rotation back into 2043 long bonds at yields north of 17.4%.

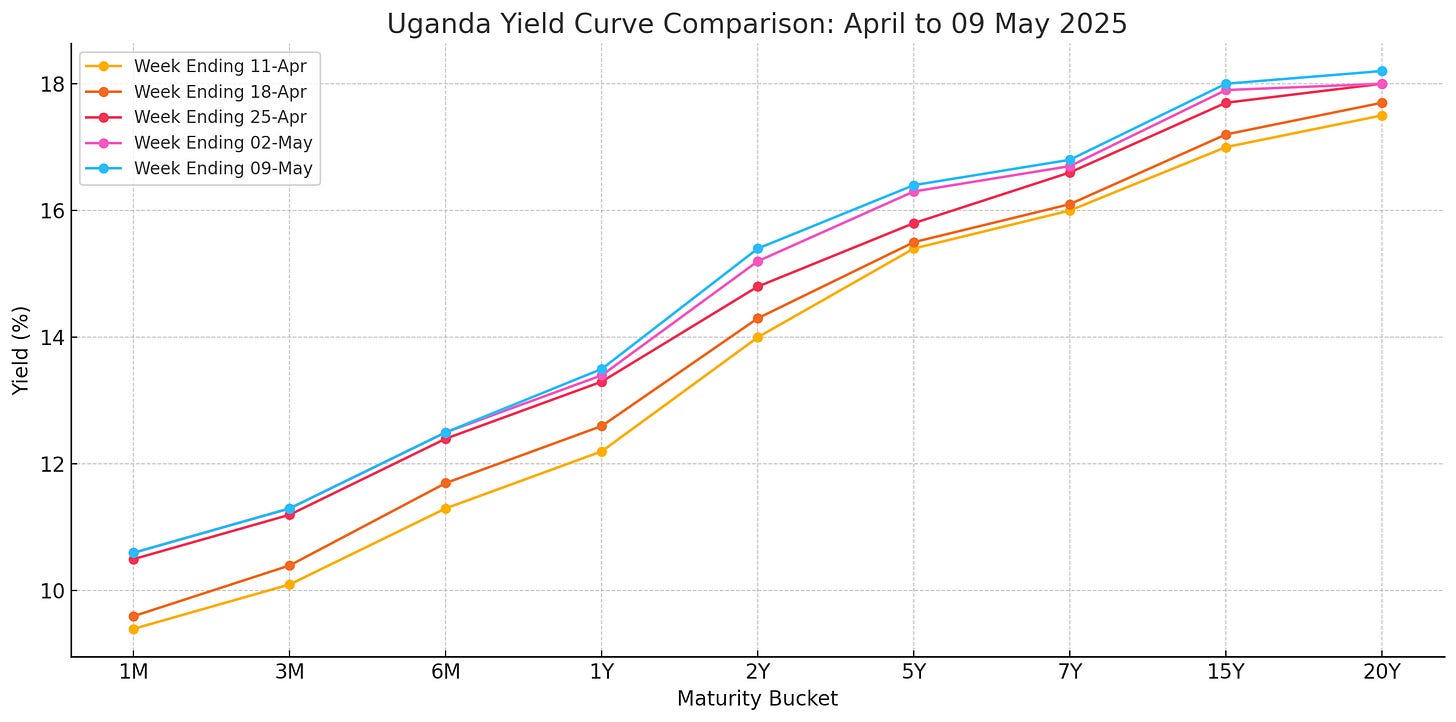

🔹 Yield Curve Dynamics

Short-term yields (0–1Y) held steady around 11.5%–12.5%.

Medium-term (2–5Y): firmed to 15.3%–16.0%.

Long-end (10Y–20Y): saw renewed appetite at high yields (17.2%–18.2%).

The yield curve remains steep, offering tactical carry and capital gain opportunities if sentiment improves ahead of the 14 May bond auction.

📈 Weekly Alpha Brief (For Active Investors)

1. Bond Market Momentum Building

Trading volume and breadth indicate growing risk appetite.

Bonds are seeing healthy two-way flows, especially around 2039/2043 maturities.

2. Curve Play: Buy Long, Sell Mid

Long bonds (15.0% 2043 and 15.8% 2039) offer ~17.5–18.2% YTM.

Mid-curve bonds have tightened slightly; reallocate duration if you expect macro stability.

3. Auction Anticipation: 14 May 2025

Expected reopenings of 3Y, 10Y, and 15Y.

Tactical buyers should enter early (this week) before pre-auction demand flattens the curve.

4. Cash + Carry

14.000% 29-May-2025 remains a strong parking play at 11.5–12.0% YTM.

Pairs well with long bonds to balance liquidity and yield.

🛍️ Look Ahead: Week Starting 13 May 2025

Primary Auction (14 May): Reopening of benchmark 3Y, 10Y, 15Y.

Watch for: Auction cut-off spreads vs. secondary market to gauge market conviction.

Trade idea: Buy midweek weakness in 2039s if yields push >17.7%.

📢 OTC Desk Call to Action

🎯 Traders, Dealers & Investment Clubs

Post your bond runs and trade interests on Impala Market. Let’s improve price discovery and deepen secondary market participation.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.