Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 30 May 2025)

UGX 2.4Trillion Private Placement Digested | 2043 Yield Holds at 18.25%

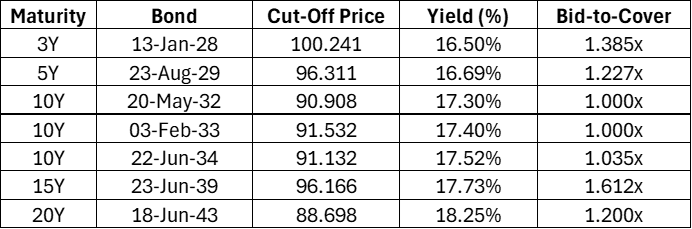

Private Placement Auction – 28 May 2025

The Bank of Uganda concluded a significant UGX 2.4 trillion private placement auction covering 7 benchmark bonds across the curve:

Key Insights:

All maturities cleared close to secondary market levels, reinforcing price discipline.

High acceptance ratios (100% for 10Y tenors) show strong targeted participation.

2043 cut-off yield (18.25%) confirms the long end remains under upward pressure.

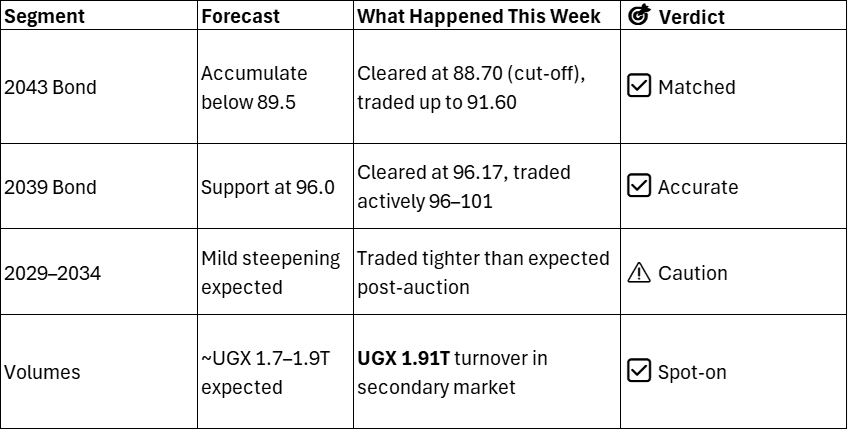

Market Performance vs Playbook Forecast (Week Ending 23 May vs 30 May)

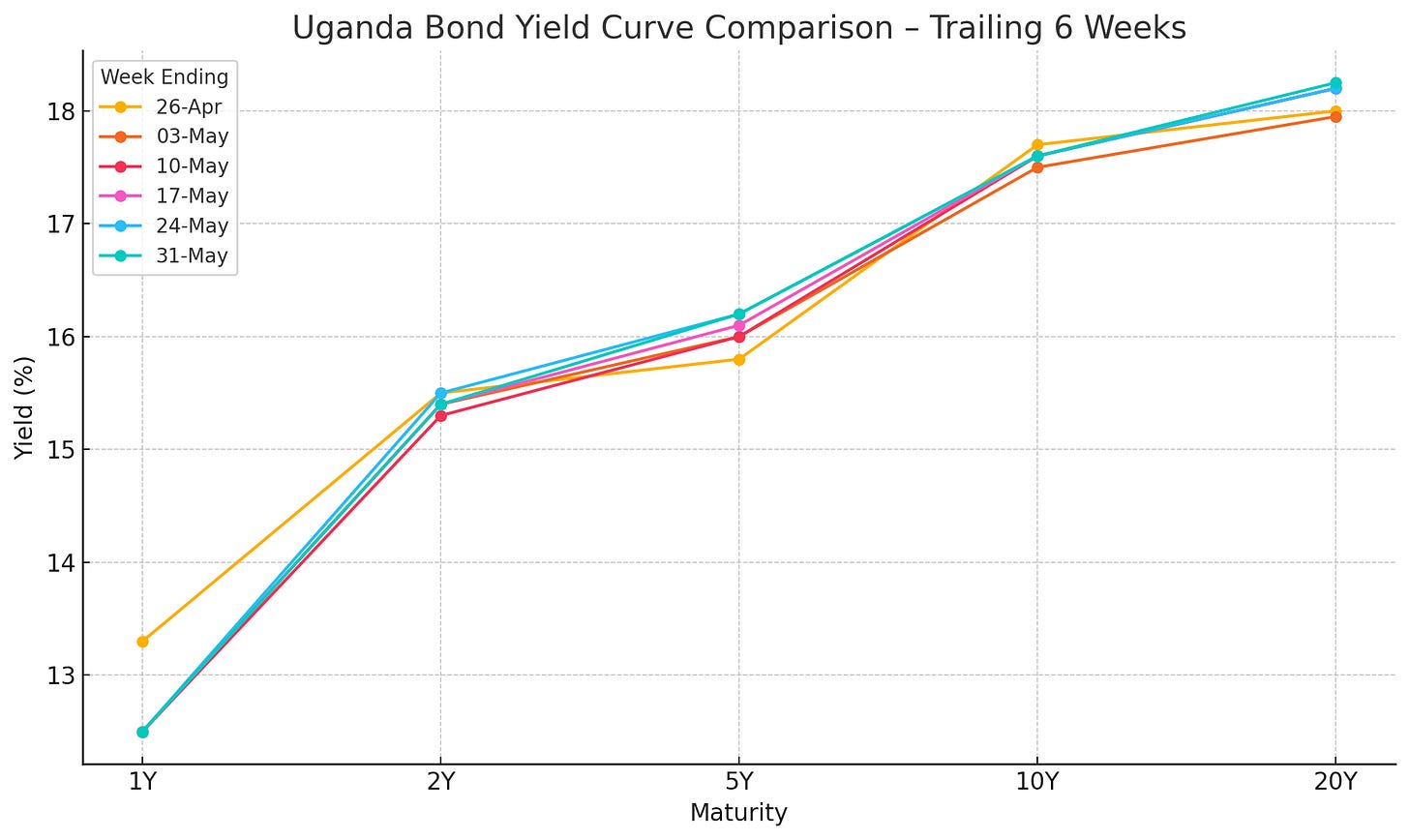

Yield Curve Comparison (Trailing 6 Weeks)

The chart below shows how yields have moved across maturities over the past six weeks:

Key Observations:

Short-term (1Y) yields are anchored around 12.5%.

Mid-curve yields (2Y–5Y) have shown gradual firming.

Long-end (10Y–20Y) continues to push higher, closing May at ~18.25%.

The curve remains steep, favoring carry and switch strategies.

Alpha Insights & Interpretation

The market absorbed the UGX 2.4T issuance without dislocation, a signal of strong institutional capacity and confidence.

Term structure remained stable, with most trades settling within ±10bps of cut-off yields.

Curve steepness persists, with 2043 yielding 18.25% vs 12.5% at 1Y, a 575bps spread.

📌 This validates carry strategies and curve switch opportunities remain in play.

Trading Strategy – Week Starting 03 June

1. Curve Carry & Rotation

Continue rotating from short-dated high-duration T-Bills into 2032–2043 for carry pickup.

2. Rebalance Long-End Exposure

Accumulate 2043 below 89.0; target exit above 91.5.

Add 2039s between 96.0–98.5 as secondary curve anchor.

3. Watch Auction Fallout

Monitor bid-offer spreads in 2029, 2034 post-placement — any softness = re-entry.

Outlook

No auction scheduled next week. Expect post-placement digestion with technical support at current yield levels.

Monitor political headlines and June budget cues for any signs of fiscal slippage.

OTC Desk Call to Action

Are you a Trader, Dealer or Investor, post your bond runs and trade interests on Impala Market. Let us improve price discovery and deepen secondary market participation in Africa.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.