Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 16 May 2025)

By Impala Market Team

Forecast Review: What We Got Right

Here’s how the forecast from the week ending 09 May 2025 compared to actual market performance:

Weekly Overview

Uganda’s bond market recorded strong turnover exceeding UGX 579 billion for the week, with the long end continuing to dominate trading.

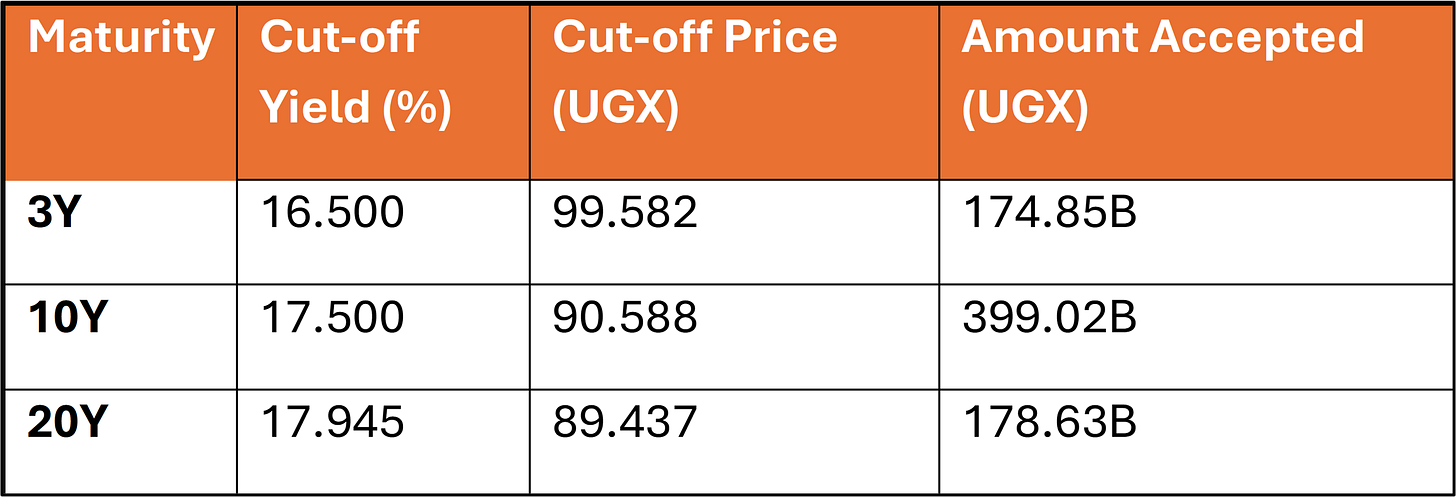

The primary market auction on 14 May saw Bank of Uganda reopen 3Y, 10Y, and 20Y benchmark bonds, receiving over UGX 1.7 trillion in bids and accepting UGX 757 billion, showing aggressive market participation across tenors.

The 20-year bond in particular saw heavy demand in the secondary market post-auction, with more than UGX 150 billion traded on 16 May alone.

Yield Curve & Volume Trends

Uganda's yield curve continued to steepen through April but began to stabilize and compress at the long end in mid-May.

Short-end yields (1Y) remained flat.

Mid-curve (3Y–5Y) tightened by 30–40bps from the peak.

Long bonds (10Y–20Y) remained sticky, trading near auction cut-offs.

Weekly turnover was UGX 579B, driven by auction benchmark bonds: 14.125% 2028 (3Y); 14.250% 2034 (10Y); and 15.000% 2043 (20Y)

Auction Impact

The 14 May bond auction materially shaped secondary market pricing:

Auction cut-offs established new fair value bands for benchmark bonds.

Curve steepness was reaffirmed by strong bid-cover ratios, especially on the 20Y (3.45x).

Institutional investors showed willingness to lock in 17.5%+ long-term yields, boosting post-auction trading in 2043s.

Post-auction, secondary yields stayed within 5–10bps of cut-offs.

Weekly Alpha Brief (Post-Auction Positioning)

1. Buy-the-Dip Opportunity

Some long bonds dipped post-auction due to profit-taking.

Accumulate 2043s if yields re-test >17.9% early next week.

2. Rotation Trade: Shift from 3Y to 10Y

Auction confirmed strong curve steepness.

Shift partial 3Y allocation into 10Y if yields remain at or above 17.6%.

3. Broadening Risk-On Sentiment

Flows expanded from core tenors to 2029, 2032, and 2039 maturities.

Institutional positioning reflects confidence in locking real yields above 17.5%.

4. Cash + Long Carry Strategy

Hold short-term liquidity in 29-May-2025 and 09-Jul-2026.

Pair with 2039 or 2043 for carry yield and potential capital gains.

So What?

📌 Key Market Insights:

Yield curve steepened in April, then flattened slightly post-auction.

Auction re-openings anchored yields and reinforced long bond price discovery.

Liquidity shifted out the curve — long bonds became more liquid than short bills.

🧭 Implications

Investors should lean into curve trades: lock in long-end carry, reduce mid-tenor exposure.

Secondary market is now using auction levels as benchmarks - improving price consistency.

Profit-taking and tactical rotations are creating intraday volatility - trade the range.

Where’s the Alpha?

2043 yields >17.9% = tactical buy.

10Y yields >17.6% = curve value vs 3Y.

Mid-curve (2028–2034) bonds are tight: take profit, wait for re-entry.

Look Ahead: Week of 20–24 May 2025

No BoU auction scheduled

Expect consolidation, with technical buying of 2039 and 2043s to resume.

Watch: 13.5% 2026, strong liquidity at 15.5% – 15.9% YTM.

OTC Desk Call to Action

Traders, Dealers & Investors

Post your bond runs and trade interests on Impala Market. Let’s improve price discovery and deepen secondary market participation.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.