Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 14 June 2025)

This Week in Summary

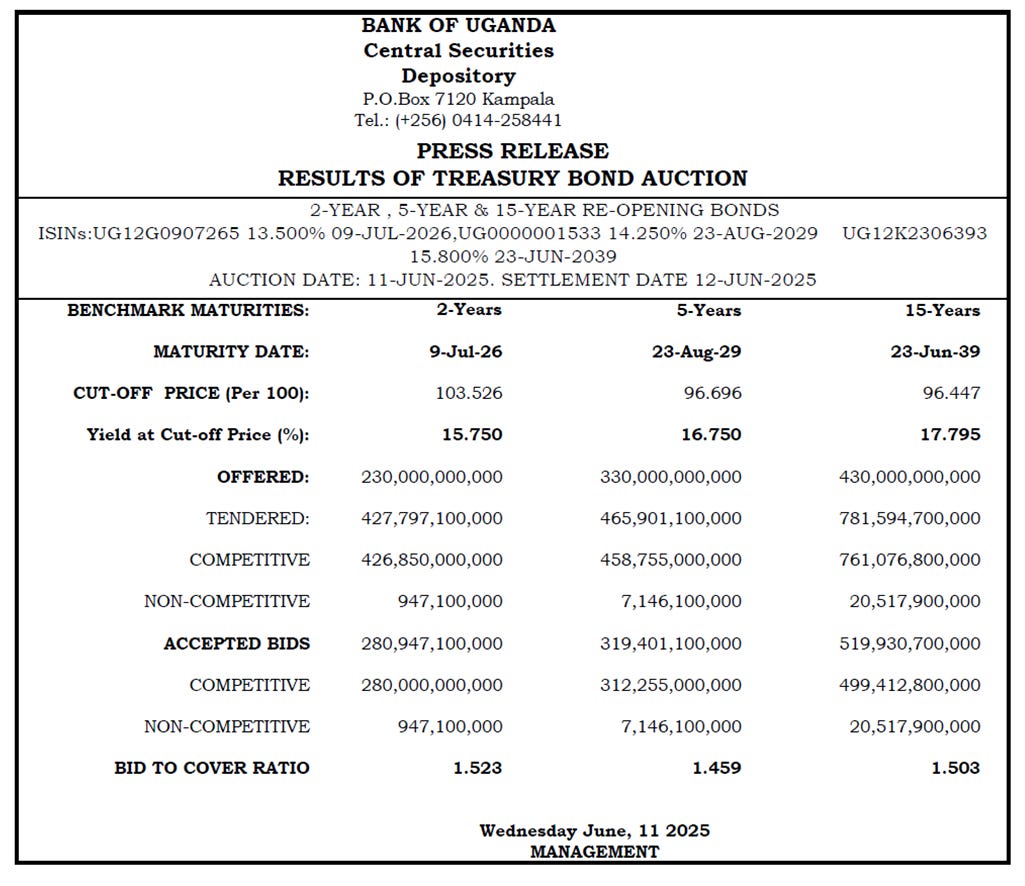

BoU auctioned UGX 990B across 2Y, 5Y, and 15Y bonds

UGX 1.09T accepted across all tenors – strong demand sustained

Secondary yields tightened across long bonds (up to 50bps compression)

Curve barbell trades and reinvestment rotation strategies remained in play

Upcoming: T-Bill auction (19 June), June budget speech in focus (12 June)

Auction Results - 11 June 2025

The BoU reopened 3 key benchmark bonds. Bid-to-cover ratios stayed healthy at 1.4×–1.5× across the curve.

All cut-offs cleared close to secondary levels - no surprises, and no panic.

Secondary Market Activity

Total weekly turnover slowed to UGX 1.47T, down from UGX 1.91T the week prior.

Most Active Bonds:

15.00% of 18-Jun-2043 → YTM: 18.05–18.25%

15.80% of 23-Jun-2039 → YTM: 17.45–17.80%

14.25% of 23-Aug-2029 → YTM: 16.20–16.75%

Key Yields:

2Y: ~15.85%

5Y: ~16.60%

10Y: ~17.60%

15Y: ~17.45–17.80%

20Y: ~18.25%

The 15Y bond gained 45–50 bps post-auction, offering instant capital gains to auction buyers.

Alpha Brief

Alpha Brief vs Market Outcomes:

Yield Curve Comparison (Trailing 6 Weeks)

The chart below shows how yields have moved across maturities over the past six weeks:

Key Observations:

1Y yields remain stable at 12.5%, the short end is anchored.

2Y and 5Y yields have firmed notably over the last two weeks, signaling rising reinvestment risk.

10Y remains flat at 17.6%, while 15Y eased slightly, showing tightening risk premium.

20Y yield has plateaued around 18.25%, signaling a ceiling, unless macro risks escalate.

Alpha Insights & Interpretation

Yield Compression = Return of Confidence

Long bonds (especially 2039s, 2043s) saw price action tighten yields post-auction. The market rewarded investors who entered near yield ceilings (≥17.8%).Short End Remains Anchored

2Y and T-Bills are tightly priced. BoU has signaled its intent to hold the front-end stable as budget execution begins.Steepness Is Alive

The curve still pays 250–300bps to move out the duration ladder. This means carry trades remain valid, especially using a barbell strategy.

Trading Strategy - Week Starting 16 June

Position Ahead of July Supply

With the FY2025/26 budget now public, expect heavier bond issuance next quarter. Get long-end exposure while yields are still near highs.Target 2043 Around 89.00

YTM of 18.2–18.25% represents a potential top. Use any dip to reload. Avoid chasing above 91.Reinvest Short-Term Cash Into 2Y

Skip new T-Bills unless yields spike. The 2-Year bond (2026) at 15.75% offers better returns and flexibility.

Outlook

Next Auction: Treasury Bills, 19 June 2025

Watch for:

June Budget Readings

Closely monitor follow-up implementation plans, deficit financing clarity, and Q1 domestic issuance signals. These will shape yield curve direction going into July.Political Rhetoric & Sentiment

The long end of the curve (15Y–20Y) is especially sensitive to early election positioning, governance debates, and macro stability concerns.Liquidity Conditions & Bid/Offer Spreads

As banks and primary dealers manage mid-year cashflows, wider secondary spreads could signal stress, or opportunity, particularly in thinly traded off-benchmark papers.

OTC Desk Call to Action

Are you a Trader, Dealer or Investor, post your bond runs and trade interests on Impala Market. Let us improve price discovery and deepen secondary market participation in Africa.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.