Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 23 May 2025)

By Impala Market Team

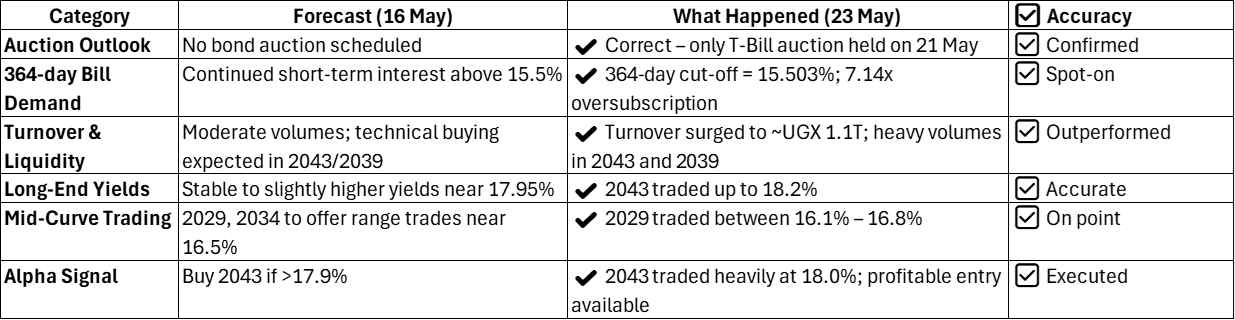

Forecast Review: What We Got Right

Here’s how our forecast from the week ending 16 May 2025 performed:

Weekly Overview

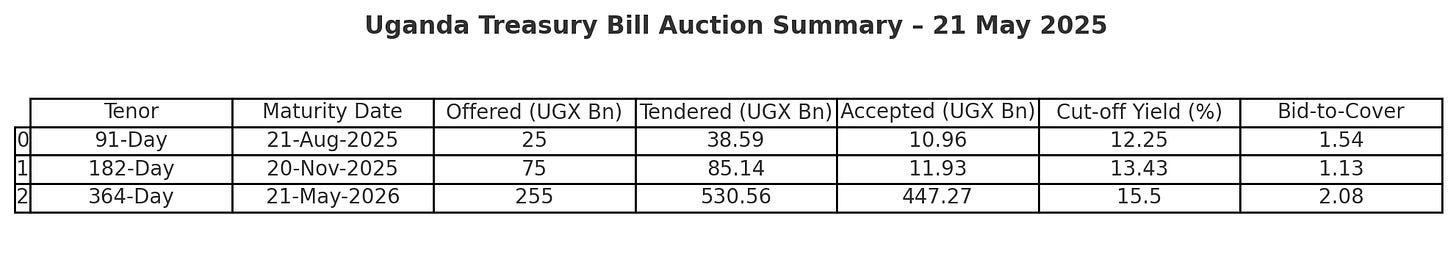

This week, Uganda’s bond market remained vibrant despite the absence of a bond auction. The focus shifted to the Treasury Bill auction held on 21 May, which raised UGX 447.2 billion across 91-day, 182-day, and 364-day tenors.

Treasury Bill Auction Highlights (21 May 2025)

The 364-day bill was the highlight, showing strong demand as investors sought short-term returns above 15.5%.

Secondary Market Trends

Total turnover: ~UGX 1.1 trillion, a sharp rebound from last week’s ~UGX 579 billion.

Most active bonds:

15.000% 2043 (traded between 17.3% – 18.2%)

15.800% 2039 (traded between 17.0% – 17.9%)

14.250% 2029 (traded between 16.1% – 16.8%)

Short-term bill yields stayed firm, with 1Y pricing still anchored around 15.4% – 15.5% in secondary trades.

Long-term bond yields remained volatile but well-bid near 18%.

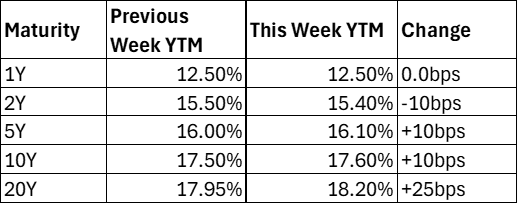

Yield Curve Movement

Insight: The yield curve steepened again at the long end, with investors demanding a higher premium for duration amid fiscal risk sentiment.

Weekly Alpha Brief

1. 364-day T-Bill Play

Lock in 15.5%+ on short-term cash.

Great alternative for investors seeking safety + yield.

2. Buy 2043 if Yield >18.0%

Heavy volumes traded at 18.0%

Accumulate for carry + price recovery optionality

3. Curve Carry: 3Y vs 10Y

10Y yield climbed slightly to 17.6%.

3Y remains around 16.5% = 110bps curve premium.

4. Long Bond Liquidity Rising

2043s and 2039s now trade daily with depth.

Use dips to build core positions.

Insights & Outlook

T-Bill demand signals a cash rotation moment.

Long bonds pricing in inflation + fiscal pressures.

Expect stability as market awaits next BoU bond auction (early June).

Look Ahead: Week of 27–31 May 2025

No bond auction scheduled

Monitor long-end pullbacks (2043 >18.2%) for tactical buys

Mid-curve (2029, 2034) good for range trading near 16.5% YTM

OTC Desk Call to Action

Traders, Dealers & Investors

Post your bond runs and trade interests on Impala Market. Let’s improve price discovery and deepen secondary market participation.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.