Impala Market Weekly Commentary: Uganda Bond Market (Week Ending 25 July 2025)

60‑second brief

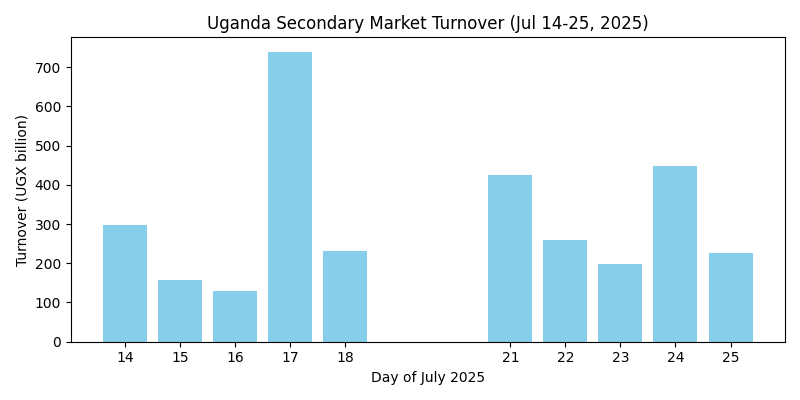

High turnover continues. Secondary market activity remained heavy with total turnover of ≈ UGX 4.26 trillion over the fortnight (≈ UGX 2.15 trillion in the week of 14‑18 Jul and ≈ UGX 2.10 trillion in the week of 21‑25 Jul). The busiest session was Thursday 17 Jul, when more than UGX 738 billion changed hands. The daily turnover profile is illustrated in the bar chart below.

Mid‑curve demand compresses yields. Average yields on the 2029 benchmark tightened to around 16.0 %, while the 2035 (10‑year) paper traded around 16.8 %. Strong pension and insurance demand compressed yields in the 7‑ to 10‑year sector and kept the 14.25 % Aug‑2029 and 16.25 % Nov‑2035 benchmarks well bid.

Long‑end volatility persists. The 20‑year 15.00 % Jun‑2043 bond saw a wide trading range; yields oscillated between ≈ 15.3 % and 19.4 % during the fortnight. Large blocks at yields in the high‑17s were absorbed, but several prints around 17.3 %–17.5 % suggest the market is searching for equilibrium at slightly lower levels.

Offshore flows mixed. Offshore investors continued to take profits in long‑duration bonds, while local pension funds rotated out of Treasury Bills into mid‑curve bonds. Spreads between on‑the‑run and off‑the‑run 10‑year issues narrowed as dealers rebuilt inventory.

Macro backdrop stable. The Bank of Uganda (BoU) kept its benchmark rate unchanged at 9.75 % at its May policy meeting, citing subdued inflation (headline inflation ticked up to 3.5 % in April while core inflation rose to 3.9 %). Stable short‑term rates supported demand for longer‑dated securities.

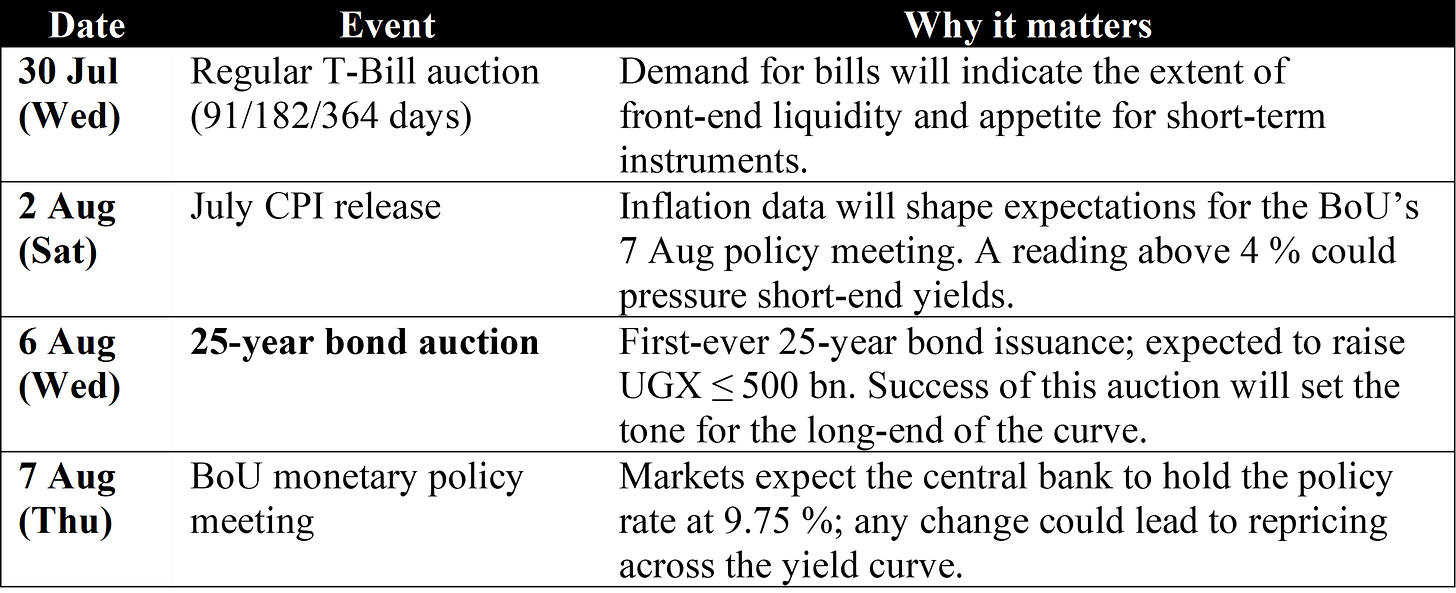

Look ahead. There is no primary bond auction scheduled in the coming week, but the market is preparing for the first‑ever 25‑year bond to be auctioned on 6 Aug. BoU officials have noted that extending maturities reduces refinancing pressure and lowers borrowing costs. Weekly Treasury‑bill auctions continue, and traders will monitor inflation data due early August.

Quick Numbers

Secondary market activity

Turnover and trade count

The secondary market continued to witness very high liquidity. Activity was concentrated around 17 July (ahead of weekend positioning), while the week of 21–25 July saw steadier flows. In total ≈ 1 300 trades were reported during the fortnight, with an average trade size of about UGX 3.3 billion.

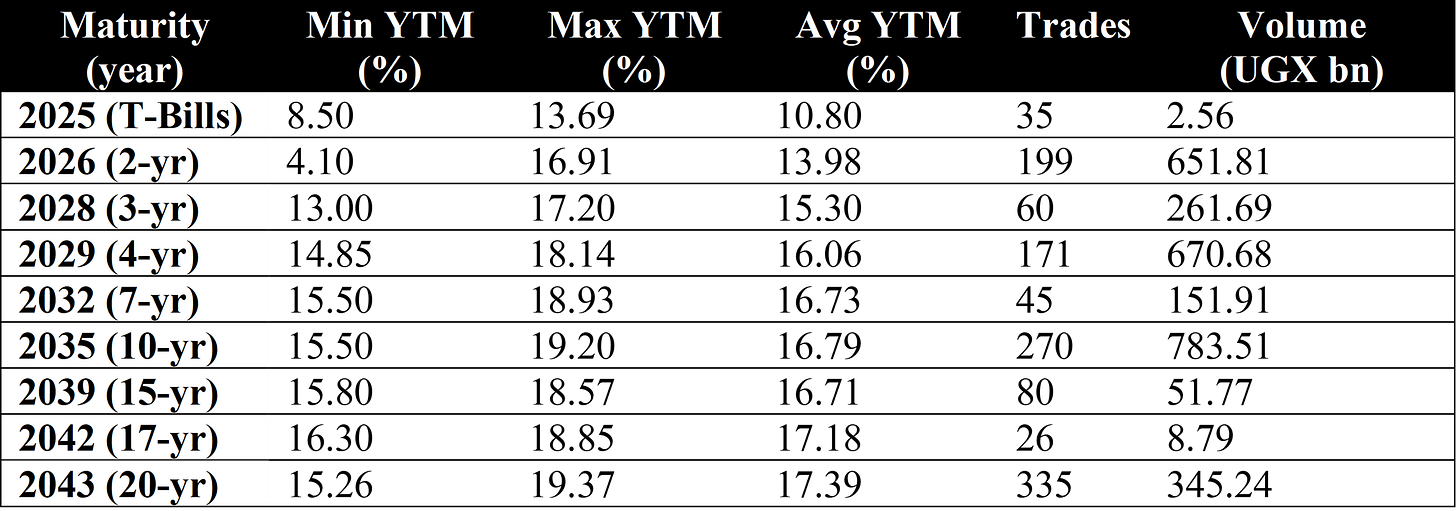

Bond‑by‑bond performance

The 2043 bond (20‑yr) and 2035 bond (10‑yr) dominated both trade counts and volumes, reflecting benchmark status. A summary of yield ranges and traded volumes across key maturities is tabulated below.

Yields for the 2029, 2035 and 2043 benchmarks during the fortnight drifted higher in the second week as traders took profits and prepared for the upcoming 25‑year bond issuance.

Trading desk intelligence

Duration rotation: continued rotation out of Treasury Bills into mid‑curve bonds as banks and pension funds sought yield pick‑up. The 14.25 % Aug‑2029 and 16.25 % Nov‑2035 benchmarks were in high demand, compressing spreads.

Offshore selling in long end: Offshore investors took profits in the 20‑year and 15‑year sectors, resulting in occasional block trades at yields above 17.8 %. Despite the selling, local demand absorbed supply and yields retreated towards 17.3 % by the end of the week.

Liquidity conditions: Average bid‑offer spreads widened slightly (≈ 10–15 bps) during large block transactions but narrowed quickly on normal‑sized trades. Dealers noted improved depth in the benchmark issues, although off‑the‑run bonds remained illiquid.

Curve shape: The curve remained steep at the front end but flattened beyond seven years as mid‑curve demand compressed yields and long‑end volatility persisted.

Macroeconomic backdrop

The macro environment remains broadly supportive for Uganda’s bond market, but traders should stay nimble. With the Bank of Uganda holding its benchmark rate at 9.75 % for a third consecutive meeting (08 May 2025) and inflation still within target (headline 3.5 %, core 3.9 %), near‑term liquidity and funding costs are unlikely to change markedly.

However, policymakers have warned that global geopolitical tensions and currency volatility could force a shift in policy, so investors should keep an eye on external factors that might trigger a repricing of risk. BoU’s FY 2025/26 auction calendar plans include a new 25‑year bond on 6 Aug. The introduction of a long‑dated benchmark signals an intent to lengthen the government’s maturity profile; successful uptake could anchor long‑end yields and open curve‑steepening trades. Conversely, weak demand may push yields higher across the curve. Traders should monitor demand dynamics in upcoming auctions, particularly the debut of the 25‑year bond, to gauge investor appetite and positioning ahead of the next Monetary Policy Committee meeting (expected August 2025).

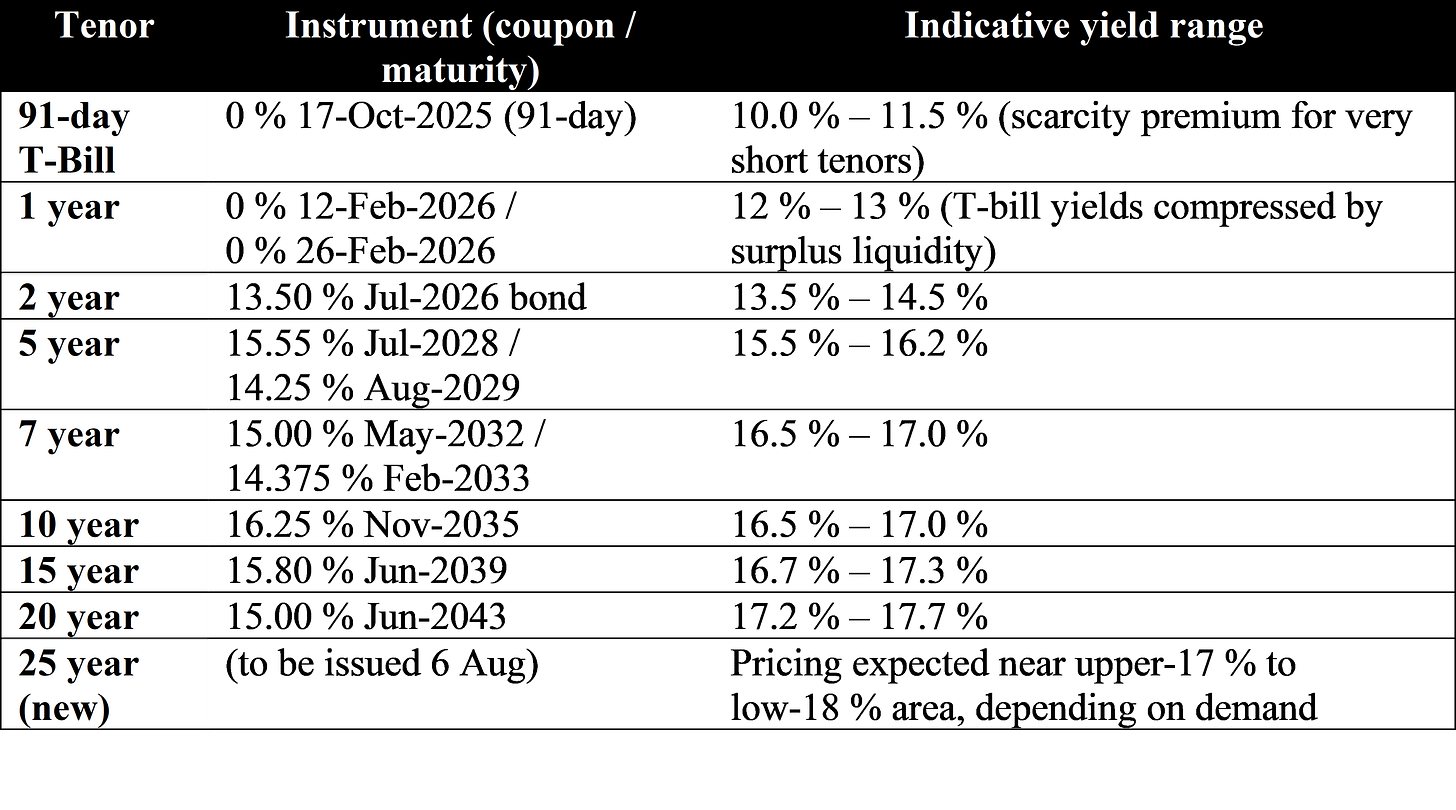

Current benchmark yields (indicative mid‑levels)

Based on indicative mid‑points from trades reported on 25 July.

Outlook: week beginning 28 July 2025

Yield‑curve scenarios

Base case (60 % probability): Mid‑curve yields remain supported and the curve continues to flatten. Dealers expect the 10‑year yield to drift towards 16.5 % and the 20‑year to stabilise around 17.2 %, as buyers position ahead of the 25‑year debut. Front‑end rates should remain anchored around 12 % given ample liquidity.

Risk case (40 % probability): A hawkish surprise from BoU (e.g. unexpected tightening at the August meeting) or a spike in global yields could prompt a bear steepening. In this scenario yields could rise 50–75 bps across the curve, with the long end underperforming.

Week‑ahead calendar

Key themes to monitor

New‑benchmark positioning. Investors will focus on how the market prices the upcoming 25‑year bond relative to existing 20‑year paper. A yield premium above 50 bps may attract pension fund demand, while a tighter spread could prompt profit‑taking on 2043s.

Mid‑curve rotation. Expect continued rotation from bills into 7‑ to 10‑year bonds as investors seek to lock in yields before the August policy meeting.

Macroeconomic signals. Inflation data and FX movements (the shilling has been relatively stable) will influence BoU’s guidance. Any signs of rising inflation or currency weakness could push the front end higher.

Offshore flows. Monitor offshore investor participation. Renewed foreign buying could compress yields further, while a risk‑off global environment would lead to further long‑end selling.

OTC desk call to action

Building Africa's bond trading community

Join the Trading Network Post your bond runs and trade interests on Impala.Market.

This Week's Sourcing Corner

Impala Market’s OTC trading network continues to facilitate block trades and price discovery.

Participants looking to sell long‑dated bonds may consider offering the 15.80 % Jun‑2039 and 15.00 % Jun‑2043 around 17.5 %–18.0 % yields.

On the buy side, there is demand for the 14.25 % Aug‑2029 and 16.25 % Nov‑2035 around 15.8 %–16.4 %. Dealers also report scarcity of 13.50 % Jul‑2026 paper.

For live runs and to post your trade interests, visit the Impala Market trading desk.

Premium Subscription Benefits:

Performance-tracked alpha calls with 78% hit rate

Advanced curve analytics and fair value models

Behavioral finance insights from institutional flow analysis

Professional trading strategies with full risk management

Priority access to sourcing network and dealer intelligence

Contact: impala.market.mail@gmail.com | Institutional rates available

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.