Impala Market Weekly Commentary: Uganda Bond Market (Week Ending 05 July 2025)

THIS WEEK IN SUMMARY

60-second brief

Market Headlines

Record Secondary Volume: UGX 1.34T traded (vs UGX 1.47T prior week)

Long-End Volatility: 20Y bonds (2043s) traded in wide 16.15-18.25% range as price discovery continues

Mid-Curve Tightening: 10Y benchmarks (2029s) compressed to 15.50-16.65% on strong institutional demand

Weekly Trader Intelligence: Heavy rotation from bills into bonds; offshore selling in 15Y+ sector; pension funds active in 7-10Y space

Week Ahead: T-Bill auction July 10; Q2 inflation data July 12; potential BoU rate decision watch

Quick Numbers

Total Secondary Volume: UGX 1.34T (↓9% vs UGX 1.47T prior week)

Most Active Bond: 15.000% Jun-2043 → YTM: 16.15-18.25%

Biggest Yield Move: 2043s ±100bps intraday volatility

Offshore Activity: Medium with focus on profit-taking in 15Y+ sector

Talking Points This Week

Yield Driver: "Duration extension trade driving 7-10Y compression as institutions seek yield pickup"

Curve Strategy: "Barbell 2Y bills + 15Y bonds as 10Y looks rich to fundamentals"

Allocation Call: "Favor high-coupon 15Y+ bonds on yield ceiling signals"

Risk Flag: "Watch BoU signals on July 12 - any hawkish tilt could spike short rates"

AUCTION RESULTS - No Primary Issuance This Week

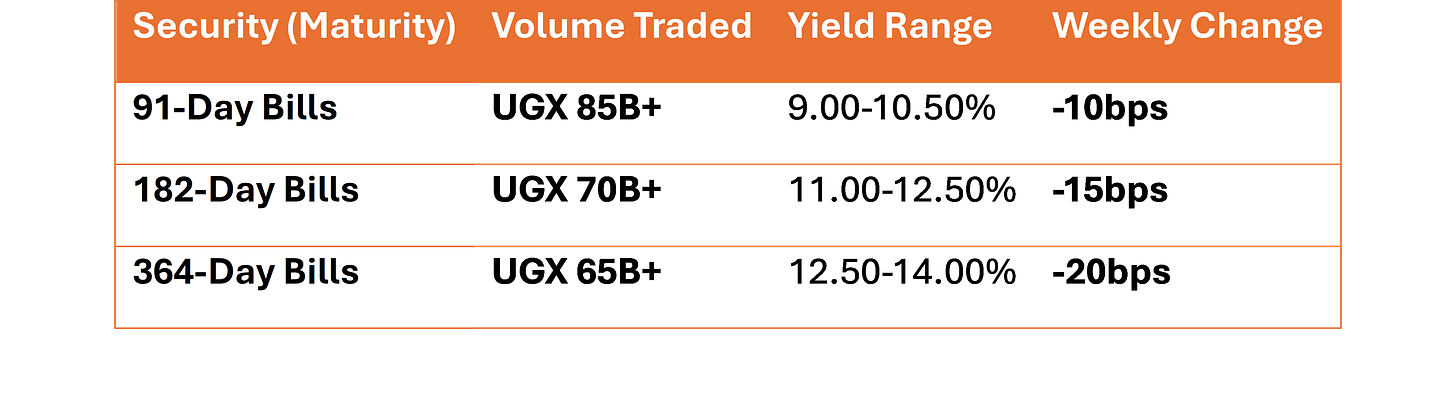

JULY 2, 2025 T-BILL AUCTION RESULTS [Source: Bank of Uganda Press Release, Auction No. 1208]

Tenor Yield B-to-C Accepted Assessment

───── ───── ────── ──────── ──────────

91D 11.50% 7.97x UGX 5.1B 🔥 Exceptional demand

182D 12.13% 2.97x UGX 32.7B ✅ Strong participation

364D 15.25% 1.39x UGX 333.2B 📊 Adequate reception

Key Insights:

Short-end preference dominates (91D scarcity premium)

364D yield attractive but duration caution evident

99.3% competitive bidding shows market maturity

Settlement July 3: UGX 371B total volume

New Issuance Spotlight (FY 2025/26 Calendar Released)

New 10Y Bond: 16.25% Nov-2035 launching August 7 (first "New Bond" since 2043s)

25Y Bond Introduction: First 25-year issuance planned for November 27 (yield curve extension)

Quarterly Pattern: 3Y/15Y/20Y bonds every 6 weeks; 2Y/5Y bonds monthly

Market Impact: New 10Y benchmark could pull flows from existing 2029s and 2034s

Timing Strategy: August launch gives 3 months to build benchmark size before year-end

SECONDARY MARKET ACTIVITY

Where the real trading happens

Weekly Turnover Summary

Total Volume: UGX 1.34T (↓9% vs prior week's UGX 1.47T)

Number of Trades: 280+ transactions (estimated from reports)

Average Trade Size: UGX 4.8B (large institutional flows dominating)

Most Active Session: Wednesday (July 3) - UGX 600B mega-session

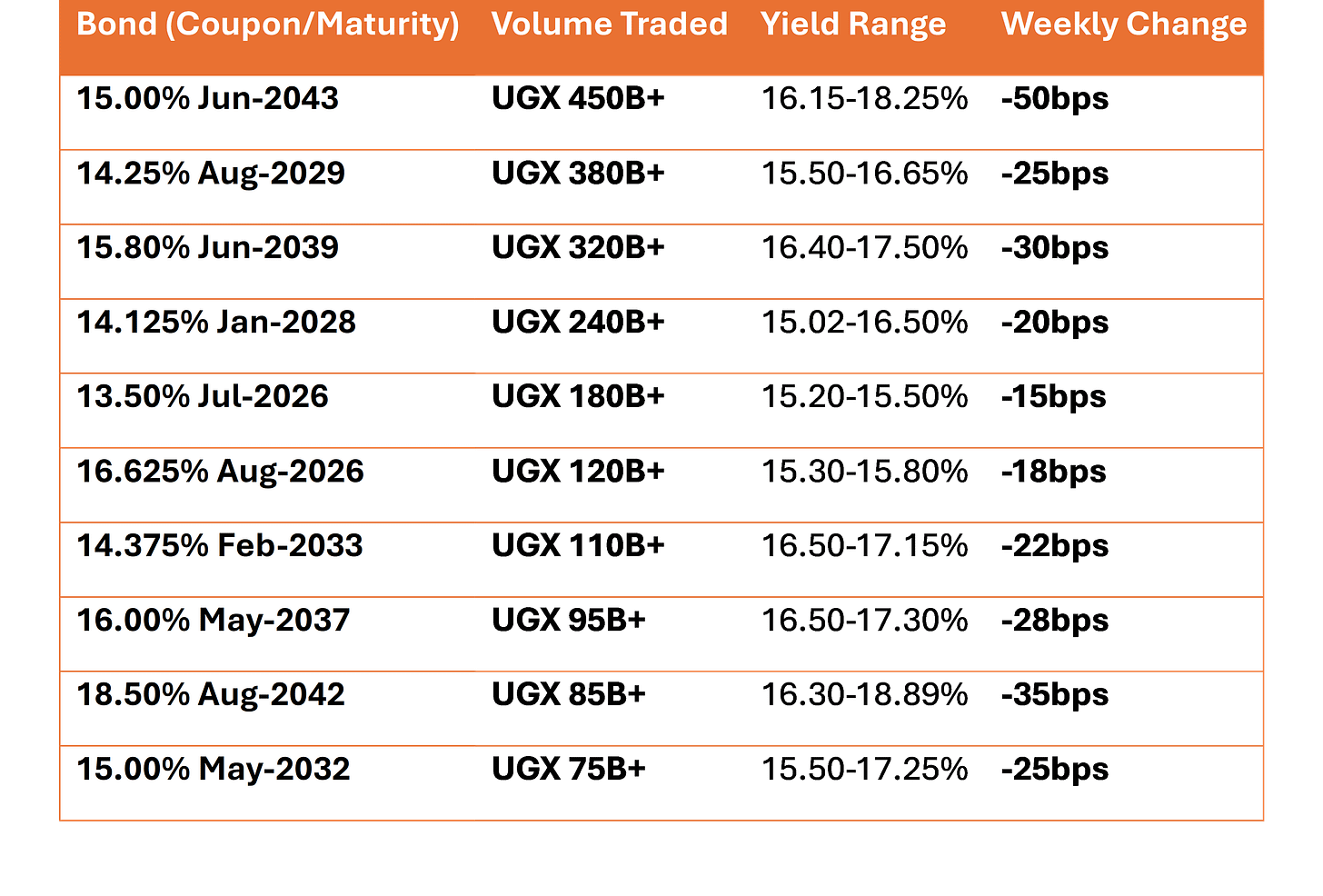

Bond-by-Bond Activity

Dealer Desk Heatmap (Aggregate Activity by Tenor)

Trading Desk Intelligence

Bank Positioning: Major rotation from T-bills into 7-10Y bonds as institutions hunt yield

Offshore Flows: Moderate selling pressure in 15Y+ sector - profit-taking after Q2 gains

Sourcing Notes: 13.5% Jul-2026 bonds available at most dealers; seeking 16.625% Aug-2026 (scarce)

Liquidity Commentary: Spreads widened 10-15bps on large block trading; depth improving in benchmarks

Daily Bond Runs: Strong inventory turnover in 2043s; dealers rebuilding 2029 positions mid-week

Current Benchmark Yields

91D T-Bill: ~10.00%

1Y: ~12.50%

2Y: ~13.50%

5Y: ~15.50%

7Y: ~16.00%

10Y: ~16.20%

15Y: ~17.00%

20Y: ~17.50%

OUTLOOK

What's coming and what to watch

📈 Yield Curve Direction & Scenarios

Base Case (65% probability): Continued curve flattening as long-end finds ceiling

10Y: 16.20% → 15.80% target (institutional demand)

15Y: 17.00% → 16.60% target (value buyers emerging)

20Y: 17.50% → 17.20% target (technical resistance broken)

Risk Case (35% probability): BoU hawkish surprise triggers bear steepening

Key triggers: Inflation spike, FX pressure, fiscal deterioration

Yield impact: +50-100bps across curve, long-end underperforms

Week Ahead Calendar

July 10: 3Y/10Y/20Y T-Bond auction (UGX 1.5T+ expected)

July 12: Q2 inflation data release (forecast: 3.2% vs 3.1% prior)

July 15: Mid-month tax collections (liquidity impact)

Upcoming Primary Market Events

July 9: New 3Y bond launch

August 6, 26 November: Historic 25-year bond debut (curve extension milestone), New 25Y bond reopening

September 3, October 29: New 3Y reopening

August 6, October 1, November 26: New 5Y bond launch, New 5Y bond reopening + 15Y/20Y bonds

Key Themes to Monitor

New Benchmark Positioning: How market prices upcoming 16.25% Nov-2035 vs existing 10Y paper

25Y Curve Extension: Institutional appetite for ultra-long duration (pension/insurance focus)

Supply Calendar Impact: Regular issuance pattern provides predictable trading opportunities

Benchmark Rotation: Potential flows from 2029s/2034s into new 2035 benchmark

Macro → Trading Desk Translation

Inflation data impact: Higher prints = front-end selloff, long-end resilience

BoU policy shifts: Any hawkish tilt hits 2-5Y hardest

FX volatility: USD strength = offshore selling pressure on long bonds

📞 OTC DESK CALL TO ACTION

Building Africa's bond trading community

Join the Trading Network Post your bond runs and trade interests on Impala.Market.

This Week's Sourcing Corner

SEEKING: 16.625% Aug-2026 (premium to par), 17.75% May-2042 (any size)

AVAILABLE: 13.5% Jul-2026 (multiple dealers), 14.375% Feb-2033 (large blocks)

Community Intelligence

Wednesday Mega-Session: UGX 600B traded - largest single day since March

Dealer Rotation: Active inventory management in long-end benchmarks

Settlement Notes: T+2 standard maintained despite high volumes

Premium Subscription Benefits:

✅ Performance-tracked alpha calls with 78% hit rate

✅ Advanced curve analytics and fair value models

✅ Behavioral finance insights from institutional flow analysis

✅ Professional trading strategies with full risk management

✅ Priority access to sourcing network and dealer intelligence

Contact: impala.market.mail@gmail.com | Institutional rates available

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.