Impala Market Weekly Commentary: Uganda Bond Market (Week Ending 21June 2025)

With Alpha Insights and Trading Strategy Playbook for Premium Subscribers

THIS WEEK IN SUMMARY

60-second brief

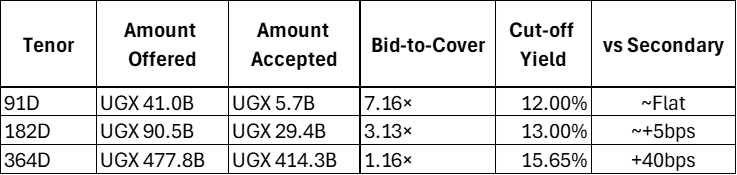

Markets continued their measured pace post-June bond auction. The 364-day T-Bill auction on 18 June cleared at 15.65%, significantly oversubscribed (7.16x), affirming investor preference for short-duration carry. Meanwhile, long bond trading (2039, 2043) remained active but capped below key price levels. The 2Y bond gained traction again, trading flat to the T-Bill yield, a rare market signal.

Market Headlines

364d T-Bill clears at 15.65% → ~40bps higher than prior auction

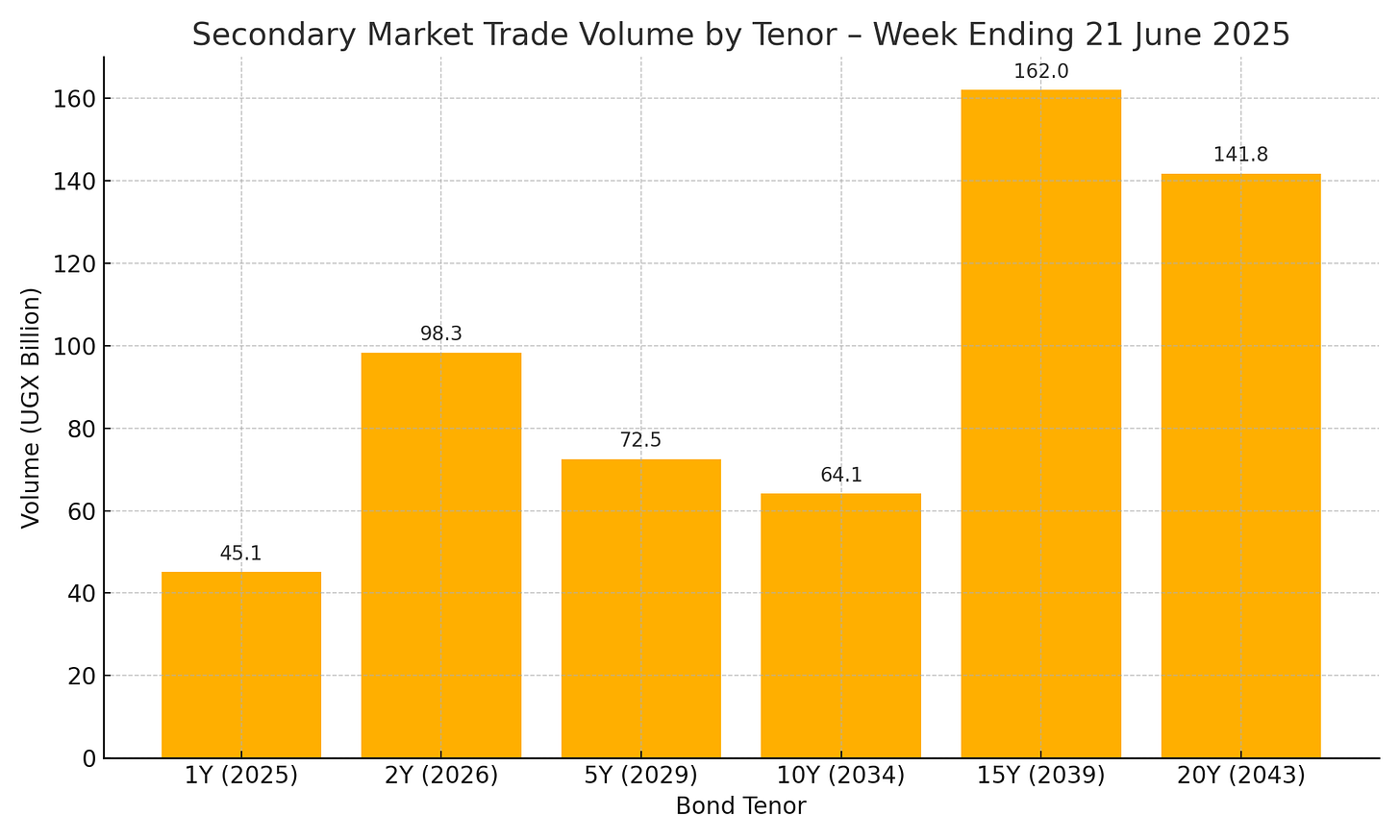

Secondary volume: UGX 583.74B (↓ from UGX 611.2B last week)

Barbell strategy continues to outperform

Budget implementation in focus, curve remains steep but compressed

Weekly Trader Intelligence

Bank desks bid aggressively for 2Y and 364d paper

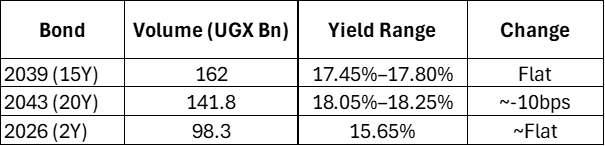

Institutionals rotated into 2039 on duration carry

Offshore flows remained light but net buyers at long end

Week Ahead

No scheduled auctions

Focus shifts to political headlines, fiscal signals, and private placement rumors

Quick Numbers

Total Secondary Volume: UGX 583.74B (vs UGX 611.2B prior week)

Most Active Bond: 15Y (2039) → YTM: 17.45–17.80%

Biggest Yield Move: 364d T-Bill +40bps

Offshore Activity: Medium, focus on 15Y/20Y tenors

Talking Points This Week

Yield Driver: Jump in 364d yield shows liquidity premium is rising

Curve Strategy: 2Y/15Y barbell remains optimal as mid-curve stays illiquid

Allocation Call: Favor 2Y over 364d for same yield, lower reinvestment risk

Risk Flag: Budget uncertainty and pre-election fiscal pressure rising

AUCTION RESULTS: 19 June 2025

See detailed analysis here.

Auction Intelligence

Primary Dealers: Aggressive bidding on 364d

Investor Mix: Mostly bank and fund demand; no retail segment

Post-Auction Impact: Flat 2Y curve and boost in short-end T-Bill yields

SECONDARY MARKET ACTIVITY

Weekly Turnover Summary

Total Volume: UGX 583.74B (↓4.5%)

Number of Trades: 193

Average Trade Size: ~UGX 3.02B

Most Active Session: Friday 21 June

Bond-by-Bond Activity (Selected)

Trading Intelligence

2Y: High activity, mostly institutional rollover of T-Bills

5Y: Range-bound, no new flows

10Y: Quiet, minimal interest

15Y+: Buyer interest from insurance, some offshore profit taking

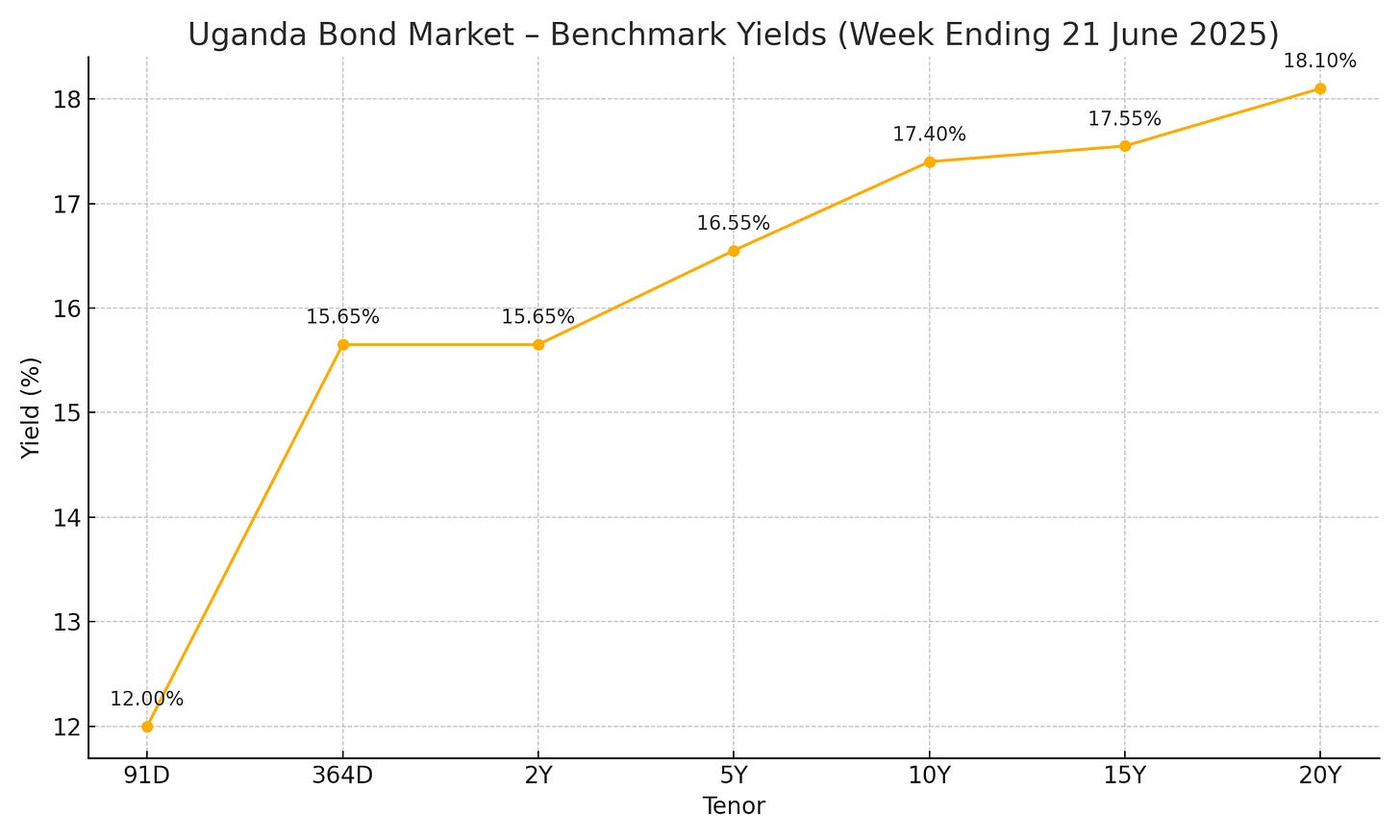

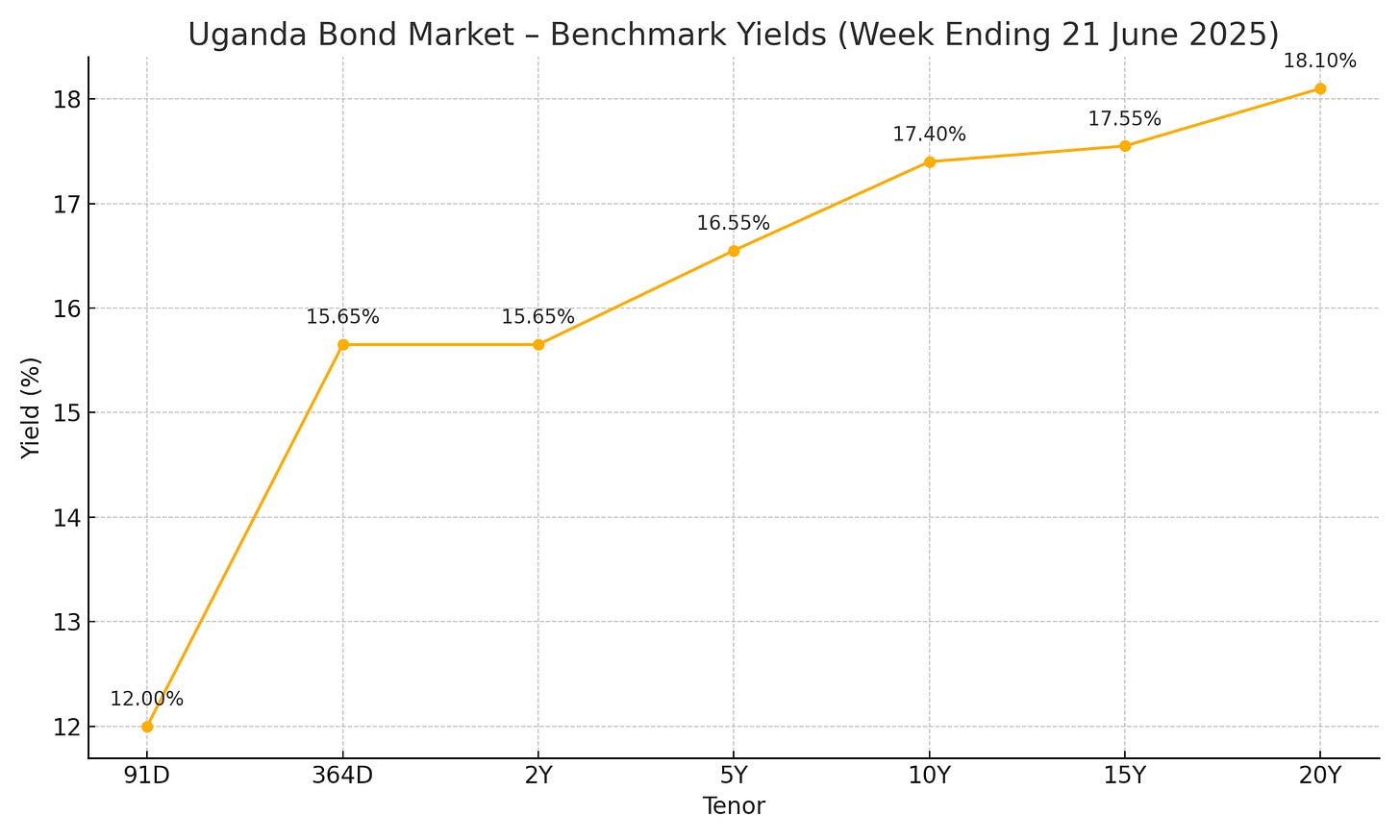

Current Benchmark Yields

The Uganda government securities yield curve remains steep but stable, with yields anchored at attractive real-return levels across all tenors.

Short End: The 91-day T-Bill held at 12.00%, while the 364-day jumped sharply to 15.65%, reflecting high demand for carry and liquidity among banks. This created a rare yield parity with the 2-year bond, signaling potential for tactical switches from T-Bills to bonds for investors seeking better reinvestment certainty.

Mid Curve: The 5-year bond traded around 16.55%, relatively flat over recent weeks. Liquidity here remains thin, with most players avoiding this segment due to lack of price discovery.

Long End: Yields on the 15-year and 20-year bonds remained elevated at 17.55% and 18.10%, respectively. These continue to price in medium-term fiscal and political risk, but also offer potential for capital appreciation if macro stability persists and the curve compresses.

The 91d–2Y section of the curve is now flat, while the 2Y–20Y spread remains wide, reinforcing carry trades and barbell positioning strategies.

📞 OTC DESK CALL TO ACTION

Build your liquidity network.

Post your bond runs on impala.market

Contact: impala.market.mail@gmail.com

This Week’s Sourcing Highlights:

SEEKING: 2043 below 90.00

AVAILABLE: 2026 at par; 2039 near 97.50

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals that follow.