Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 02 May 2025)

By Impala Market Team

🗓️ Market Summary

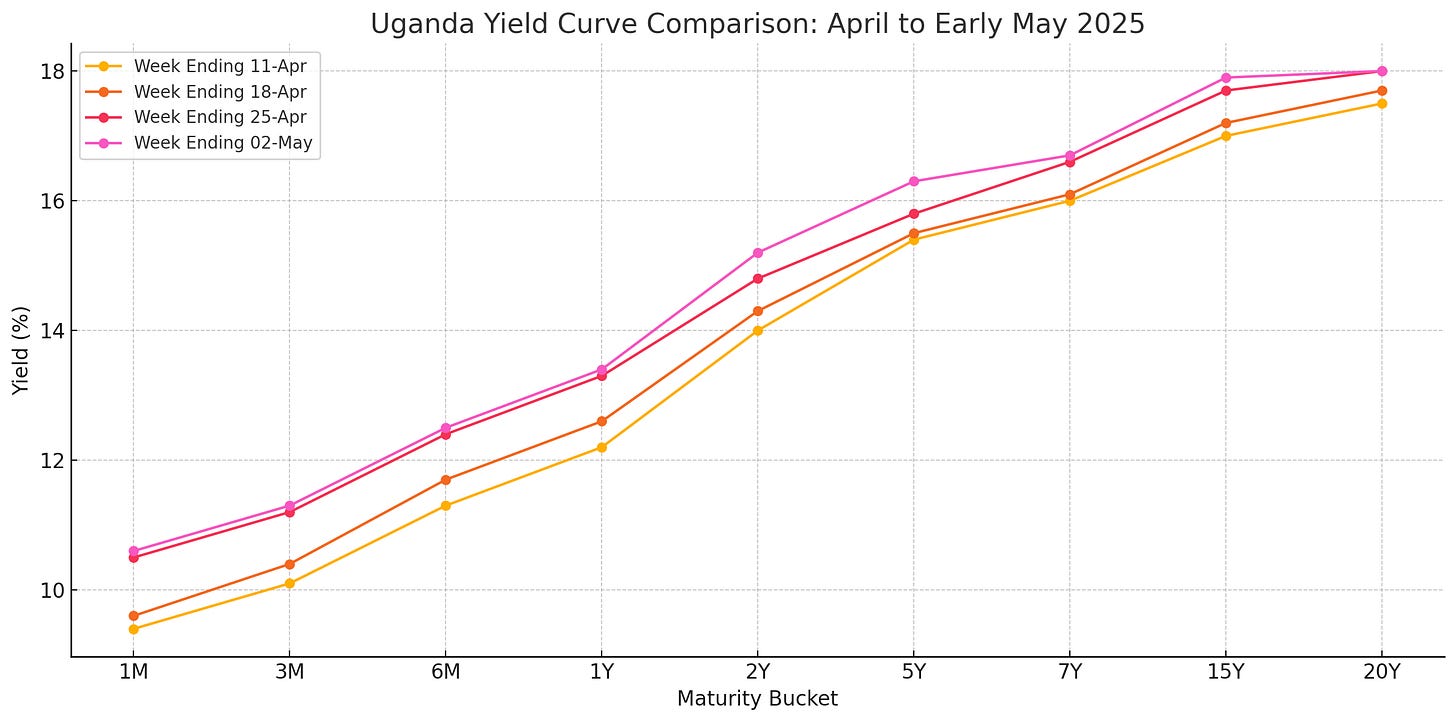

Secondary market activity surged the week ending 02 May 2025, with traded volumes reaching UGX 862.7 billion, a 52% increase from UGX 567.2 billion last week. Notably, long-dated bonds such as the 2043s and 2039s dominated activity. The yield curve continued to bear-steepen, especially in the 15Y–20Y segment, while short-term T-Bill rates remained relatively anchored.

📈 Yield Curve Snapshot – Comparison (Week Ending)

🧠 Key Insight:

The yield premium on long bonds over mid-curve benchmarks (5Y and 7Y) remains elevated. This creates tactical buying opportunities for investors seeking to lock in real yields before inflation expectations shift.

💸 Auction Impact

While no Treasury Bill or Bond auctions occurred this week (and none are scheduled until 14 May 2025), the impact of last week’s T-Bill auction (24 April) reverberated through the short end:

91-day bill cut-off remained stable at 9.349%, aligning closely with secondary market rates.

High demand and reinvestment flows from maturing bills contributed to short-end support.

🔍 Weekly Alpha Brief

✅ 1. Follow the Flow: Trading this week spiked. Big players were actively buying and selling the 2043 and 2039 bonds. If you're a long-term investor, this shows there’s demand — and potential exit options later.

✅ 2. Long Bonds on Sale: Yields on long bonds are high (above 17%) — meaning prices are lower. If you believe inflation is under control, now is a good time to lock in high income.

✅ 3. Short-Term Plays Are Steady: Bills and short bonds didn’t change much. If you need liquidity in the next 3–12 months, short-term bonds are still safe parking spots.

✅ 4. No New Auctions = Quiet Before the Storm? With no auctions until mid-May, expect OTC market action to continue dominating. This is a good time to negotiate deals with less pressure from auction-driven demand.

✅ 5. Volatility Creates Opportunity: Bond prices are bouncing with every large trade. Stay informed. If you're a trader, ride the swings. If you’re a buyer, wait for dips.

🔮 Look Ahead: Week of 6–10 May 2025

No auctions scheduled (T-Bill or Bond).

OTC liquidity expected to remain strong as institutions rebalance.

14 May 2025 – Next Treasury Bond auction; expect pre-positioning in 2Y and 5Y segments.

📢 Market Call to Action

🎯 Traders, Dealers & Investment Clubs

Post your bond runs and trade interests on Impala Market. Let’s improve price discovery and deepen secondary market participation.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.