Impala Market Weekly Commentary: Uganda Bond Market Insights (Week Ending 24 April 2025)

By Impala Market Team

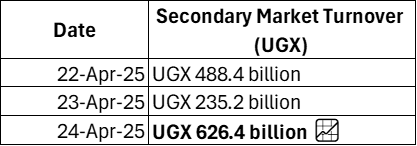

Market Overview: 22–24 April 2025

The Uganda government bond market recorded a significant rebound in trading volumes this week. Secondary market turnover surged to UGX 626.4 billion on 24 April — the highest daily turnover in the past two weeks — reversing the cautious trend observed mid-month.

This sharp rebound reflects strong liquidity in the secondary market, bolstered by renewed demand for both short-term instruments and mid- to long-term bonds.

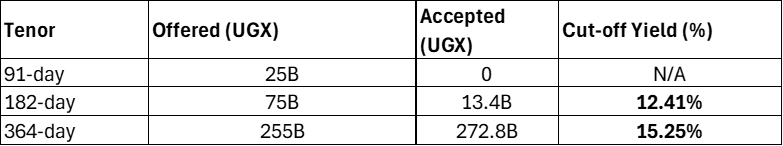

Treasury Bill Auction Results (Auction No. 1203, 23-April-2025)

The Treasury Bill auction was characterized by overwhelming demand for the 364-day paper, where UGX 272.8 billion was accepted at a competitive yield.

The decision not to issue 91-day T-Bills hints at the Bank of Uganda’s strategic move to encourage longer tenor investments and moderate short-term refinancing risks.

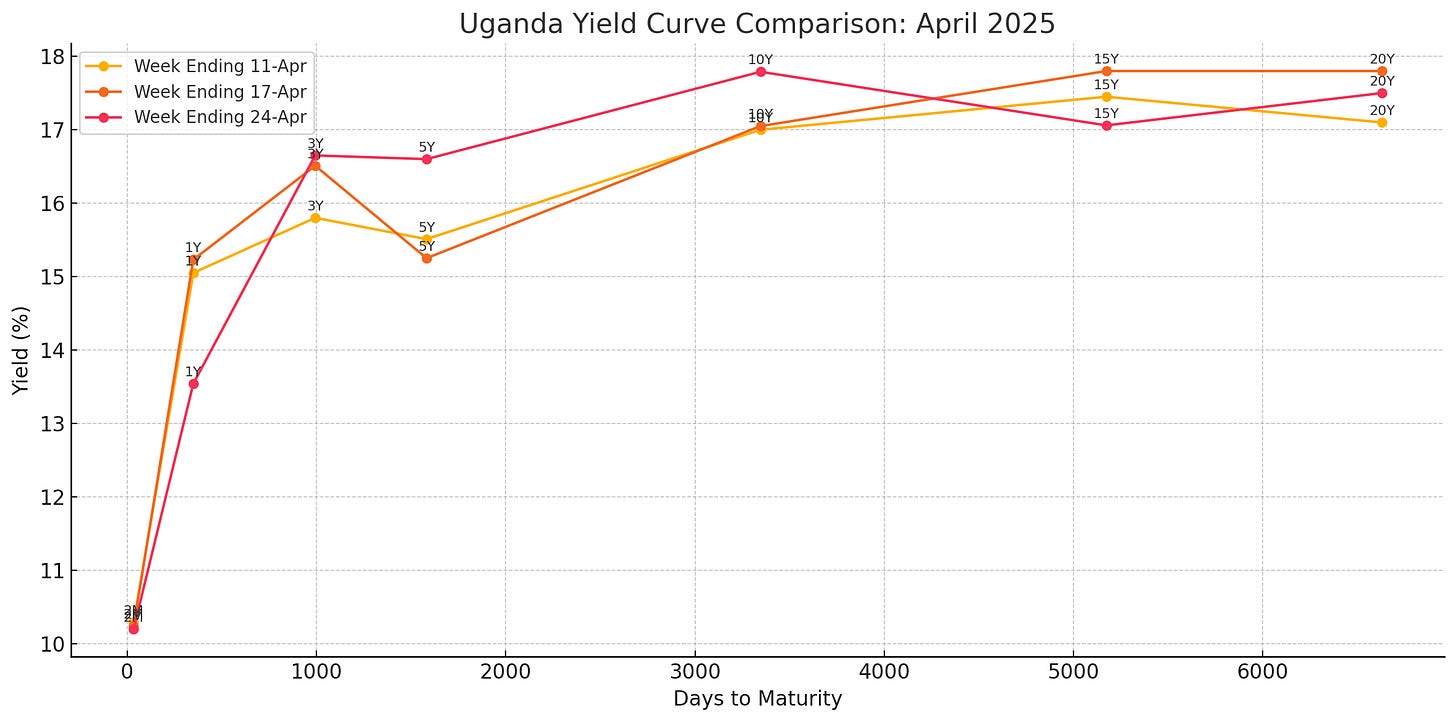

Yield Curve Evolution: 17-Apr-2025 vs 24-Apr-2025

The Uganda Government Securities yield curve flattened slightly this week, with a notable shift at the long end.

Key Takeaways:

Short-term (0–1 year): Yields remained relatively steady, anchored by auction results and secondary market demand.

Mid-to-long term (5–20 years): Yields declined, reflecting strong buying interest and moderated inflation expectations.

15.800% of 2039 bond yields fell from 17.80% to ~17.06%.

15.000% of 2043 bond yields eased from ~17.80% to ~17.50%.

Auction Influence on Yield Curves

Week Ending 11-Apr: No major auctions. Curve was stable, driven by market sentiment.

Week Ending 17-Apr: Treasury Bond auction (16-Apr) for 2Y, 5Y, and 15Y set a higher yield anchor, especially at the 15Y (17.00% cut-off), pushing long-end yields higher.

Week Ending 24-Apr: Treasury Bill auction (23-Apr) with strong 364-day demand and no 91-day issuance supported short-end stability and triggered long-end yield compression.

Trading Focus by Segment

Most Active Bonds:

Short-term Zero-Coupon Instruments (e.g., May and July 2025 maturities).

14.000% of 29-May-2025 bond continued trading at a premium above 105.

14.125% of 13-Jan-2028 and 15.800% of 23-Jun-2039 remained popular among institutional buyers.

Market Sentiment and Forward View

Stronger liquidity post-auction boosted both short and long end trading.

Long-end buying shows growing investor appetite for locking in yields before any potential future policy easing.

Treasury management strategy: BoU’s limited 91-day issuance may continue shaping the curve toward a healthier maturity structure.

Look Ahead: Week Starting 29 April 2025

Primary Auctions: No Treasury Bill auction scheduled for 30 April 2025.

Next Bond Auction: Scheduled for 14 May 2025, offering 3-year, 10-year, and 15-year bonds.

Trading Conditions:

Short-end yields (0-1 year) likely to remain stable in the absence of new supply.

Mid- to long-end bonds (5Y–20Y) could continue to firm if liquidity stays supportive.

Expect moderate secondary market trading volumes with a focus on tactical positioning ahead of the May bond reopening.

For a detailed Trading Strategy Playbook (recommended buy zones, target yields, and positioning strategy for May auctions), subscribe to Impala Market Premium.

Weekly Summary

📊 Strong T-Bill auction outcomes anchored market sentiment.

🔄 Yield curve flattened — long-end yields eased.

🚀 Turnover spiked to a 2-week high on 24 April.

📈 Focus shifts to secondary market positioning ahead of 14 May bond auction.

Stay tuned for upcoming auction previews and tactical positioning insights.

Institutional investors, licensed brokers, and OTC desks are invited to post indicative bids and offers on Impala Market. Impala Market is an information-sharing platform and not a licensed securities trading platform!

⬇️ Visit: impala.market or contact us directly to start posting.

Let's make Africa's bond market more transparent, liquid, and accessible together.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.