Impala Market Weekly Commentary, 14–16 April 2025: Uganda Bond Market Insights

By Impala Market Team

📅 Market Overview: Slower Turnover, Auction-Driven Shifts

This and next week are short trading weeks. Uganda government bond market saw a progressive slowdown in secondary market activity between 14th and 16th April.

Bank of Uganda daily secondary markets data:

Turnover fell from UGX 487B on 14-Apr to UGX 353B on 16-Apr, driven in part by investor focus on the Treasury Bond Auction held on 16 April.

Date, Total Traded (UGX): Trend

14-Apr-25, 487.0 billion: 📈 High activity before auction

15-Apr-25, 383.5 billion: 🔻 Auction positioning

16-Apr-25, 353.4 billion: 🔻 Demand shifted to primary.

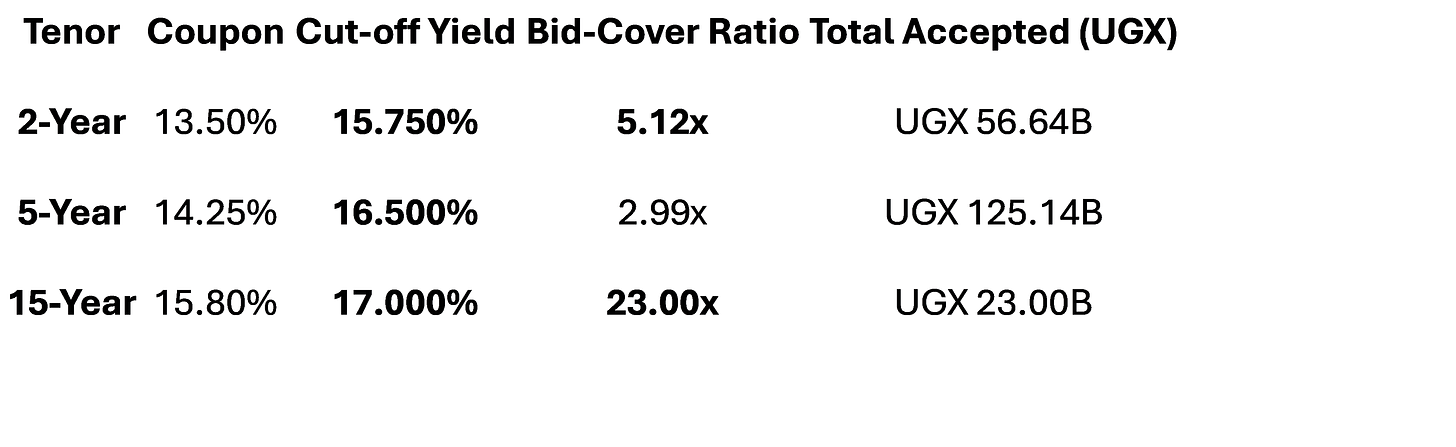

📊 Treasury Bond Auction Results (16-Apr-2025)

The auction offered 2Y, 5Y, and 15Y maturities. Demand was strongest for the 15Y bond, but BoU only accepted UGX 23B despite a record 23x bid-cover ratio, indicating tight issuance control. See a further review of the auction results here.

📌 2-Year bond saw strongest demand, with investors accepting lower yields relative to other tenors.

💰 15-Year bond had massive oversubscription but BoU issued only UGX 23B, likely to manage duration risk and anchor yields.

Comment: The auction results reaffirm investor appetite for long-term risk-adjusted returns, though BoU was cautious on duration exposure.

You can track upcoming BoU treasury auctions using our calendar on Impala Market.

📈 Yield and Price Movements (14–16 Apr)

Yields trended upward across long-term bonds:

15.000% of 2043 rose to 18.00% YTM on 16-Apr.

15.800% of 2039 traded around 17.7% – 17.9%.

Meanwhile, short-duration instruments remained stable or slightly compressed, reflecting a flight to safety.

Prices dropped on long bonds:

2043 bond: from ~90.22 to 87.97.

2042 bond: from ~103.1 to 104.1, reflecting auction uplift.

Short bonds like 14.000% of May-2025 remained in premium territory (~105.7+), indicating strong institutional demand.

🔎 Market Sentiment & Takeaways

Investors are rotating toward shorter maturities amid yield curve steepening.

Auction results provided anchor points for secondary pricing.

The 15Y bond's controlled issuance shows BoU's yield management strategy.

Overall, investor confidence remains high, but cautious around long-dated risks.

📈 Bond Spotlight: The 14.125% bond maturing on 13-Jan-2028 and the 14.000% bond maturing on 29-May-2025 remain among the most actively traded bonds and are used as key references for market liquidity.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market