Impala Market Trading Strategy Playbook: Uganda, Week Ending 06 June 2025

For Premium Subscribers Only

Market Recap – What Happened Last Week?

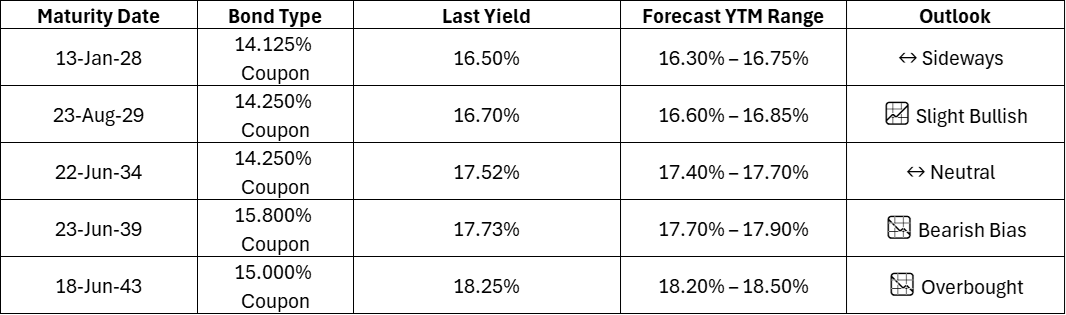

Secondary market activity surged into June with significant volumes traded in long-dated papers like the 15.000% of 18-Jun-2043 and 14.250% of 23-Aug-2029. The 2043s dominated volume, contributing over 50% of value traded across all days, with YTMs rising to 18.25% by Friday – signaling sustained bearish sentiment on duration.

Yield Pressure: Long-end yields continued drifting up – 2043s up ~50bps WoW from 17.75% to 18.25%.

Mid-Curve Demand: 2032s and 2034s saw stable demand around 90.9–91.3 price handles, with occasional rallies but no breakout.

Short-End (0% bonds): Continued high activity due to demand for cashflow recycling, especially in Q4 maturities (Oct–Dec 2025).

Yield Forecasts – Week Starting 09 June

Note: Yields above 18.00% for 2043s suggest market is still pricing in election risk, fiscal slippage, and inflation uncertainty.

Trade Recommendations

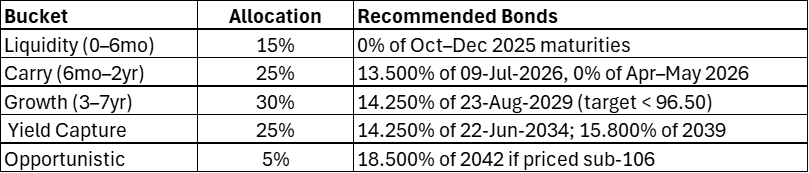

1. Ride the Mid-Curve Sweet Spot (5–9 years):

BUY: 14.250% of 23-Aug-2029 near 96.30 or lower.

Rationale: Moderate duration, ample liquidity, likely rally if rates stabilize.

2. Avoid Aggressively Adding to 2043s (Yet):

HOLD/WAIT if priced below 88.75 - too many sellers, risk of further drawdown.

Better entry may come post-July auction schedule clarity.

3. Short-Term Rotations – Tactical Gains:

BUY 0% of 10-Oct-2025 below 96.85 – clean exit potential for investors preferring capital preservation.

Portfolio Allocation Advice

For a UGX 10 billion investor looking to optimize over the next 90–180 days:

Tilt duration exposure modestly shorter. Post-June inflation print and primary dealer auction guidance may reset curve expectations.

Is the Market Pricing In Election Risk?

Yes, rising long-end yields and persistent discounts on 2043s reflect early market hedging of:

Spending pressure from a pre-election fiscal cycle,

Higher T-bill issuance to fund cash needs,

Delay in rate cuts amid food price shocks.

Watchlist: Q2 budget speech and July auction calendar.

Impala Market Trading Alpha

“If you had followed our 23-May trading playbook...”

Holding the 13-Jan-2028 (14.125%) and rotating out of 2043s would have preserved value and given 30bps in alpha.

Weekly Auction + Liquidity Signals

Expect Bank of Uganda to:

Tap into 2Y–10Y tenors to manage rollover risk,

Maintain heavy tap sales of 2043s,

Possibly offer longer-term T-bills due to retail appetite.

Closing Thought

Uganda’s bond market is navigating a tricky balance: attractive real yields vs rising macro risk. Smart positioning, especially mid-curve and selectively short, offers better capital preservation and upside in an uncertain fiscal environment.

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.