📰 Impala Market Brief — What Happened in the Uganda April 16 Bond Auction?

By Impala Market Desk – April 17, 2025

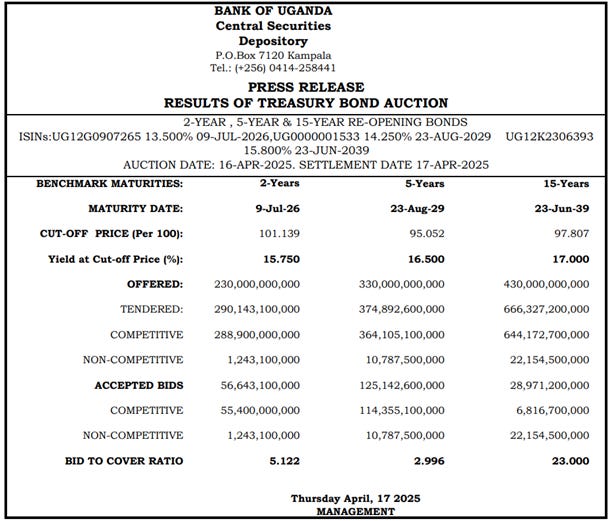

Uganda’s latest Treasury Bond auction was anything but ordinary. The Bank of Uganda re-opened the 2-year, 5-year, and 15-year bonds, but chose to take only UGX 210 billion out of UGX 1.33 trillion in bids. That tight supply decision has meaningful implications—especially for those trading or watching the secondary market and off-the-run (OTR) treasuries.

Here’s the download.

💡 What Just Happened?

2-Year (13.50% Coupon, Maturing July 2026):

Cut-off yield of 15.75%, bid-to-cover ratio of 5.12x, only UGX 56.6B accepted.5-Year (14.25% Coupon, Maturing August 2029):

Cut-off yield of 16.50%, bid-to-cover of 2.99x, UGX 125.1B accepted.15-Year (15.80% Coupon, Maturing June 2039):

UGX 666B tendered (!!), but just UGX 29B accepted. Cut-off yield: 17.00%.

The story is clear: massive demand, limited supply. And the secondary market will feel it.

🔁 OTR Bonds Are About to Get Hot

When BoU keeps primary issuance tight like this, it does two things:

It signals a desire to anchor yields.

Possibly to manage the government’s debt servicing costs or avoid spooking inflation-sensitive markets.It creates scarcity.

And where there's scarcity, there's a secondary market premium.

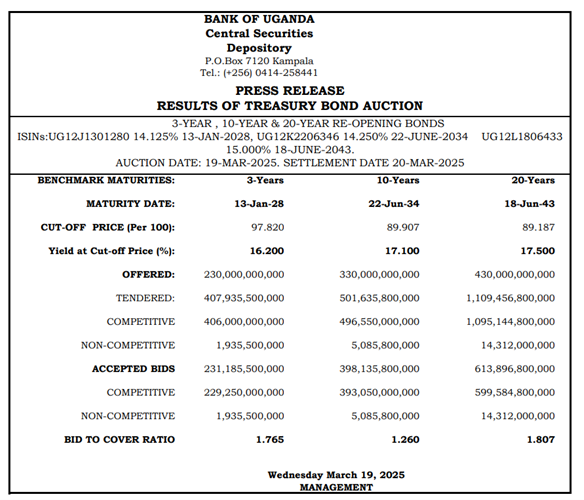

Expect investors—especially the ones shut out in the primary—to hunt for older bonds with similar duration. Think March’s 10Y and 20Y issues. These OTRs are suddenly back in style.

See the full results of the March 19 2025 auction below:

📈 Secondary Market Implications

1. Price Support for Long-End Bonds

With just UGX 29B of the 15-year accepted in this auction, anyone holding long-dated paper is holding gold. Demand spillover will likely compress yields on existing 15–20Y bonds in the secondary market.

2. Increased Trading Activity

Locked-out investors from this week’s auction will likely chase liquidity in the secondary market. Expect spreads to narrow and dealers to hold firm on pricing.

3. Flatter Yield Curve?

Look out: With a 15Y at 17.00% and a 20Y (in March) at just 17.50%, we could see a flattening or mini inversion on the long end. If BoU continues to hold back issuance, secondary pricing will adjust accordingly.

🛠 Tactical Moves for Traders

If You’re a... OTR bondholder Sit tight or price for premium resale. There’s no rush to offload when demand is high.

If You’re a... Market maker Get active. There's a window to trade the curve and arbitrage pricing gaps.

If You’re a... Investor shut out Look for older 2028–2034 bonds. They’re your next best shot for yield and exposure.

If You’re a... New buyer Consider laddering with short and long OTRs as primary access becomes selective.

🧭 Final Word: When the Primary Market Closes, the Smart Money Moves

This auction is a textbook case of how secondary bond markets come alive after a tight primary. If you're watching the market for yield, liquidity, or price action, now’s the time to lean in.

Want to invest in Africa’s treasury markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments & investment opportunities

Tailored for individual investors, investment clubs, traders & offshore investors

Subscribe for updates on Impala Market