Bond Market Outlook, Uganda: Yield Trends and Auction Forecasts for June 2025

What the Past 6 Months of Auctions Tell Us About Where Yields Are Going in June

For Premium Subscribers Only

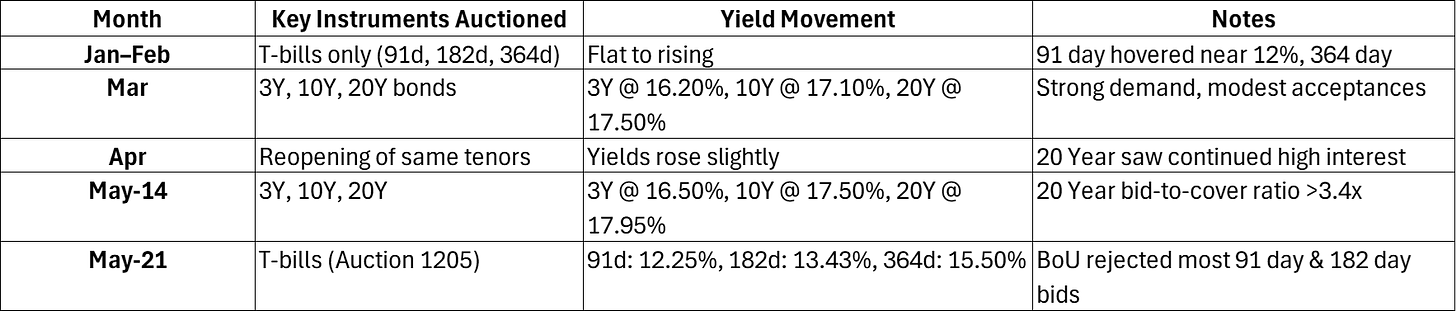

Uganda Treasury Auctions 6-Month Review (Jan–May 2025)

Over the last six months, Uganda’s Treasury market has seen a steady recalibration of yields, investor sentiment, and government funding strategy. With inflationary pressures, fiscal needs, and external funding dynamics all shifting in real time, understanding the trend in auction outcomes is critical for interpreting where rates are headed next.

The table below offers a consolidated snapshot of Treasury bond and T-bill auctions between January and May 2025, summarizing the instruments offered, how yields moved, and what these auctions revealed about market conditions at each stage.

Market Dynamics Affecting June Auctions

1. World Bank Lending Resumes

Reduced domestic borrowing pressure expected

BoU may accept less and moderate yield increases

2. UGX 2.4T Private Placement (May 28)

Provided long-duration funding to PDs + NSSF

Upcoming auctions likely to be smaller or more targeted

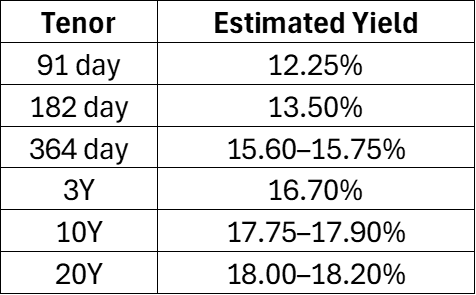

3. Secondary Market Yields (as of June 6)

As of 06 June 2025, Uganda’s secondary bond market reflected strong investor positioning in longer-term paper, with yields holding near cycle highs despite recent private placements and external funding inflows. While primary auction yields have edged upward, the secondary market suggests slightly moderated expectations—possibly pricing in improved fiscal outlook and reduced domestic borrowing pressure. Below are the indicative yields based on recent trading activity and dealer quotes:

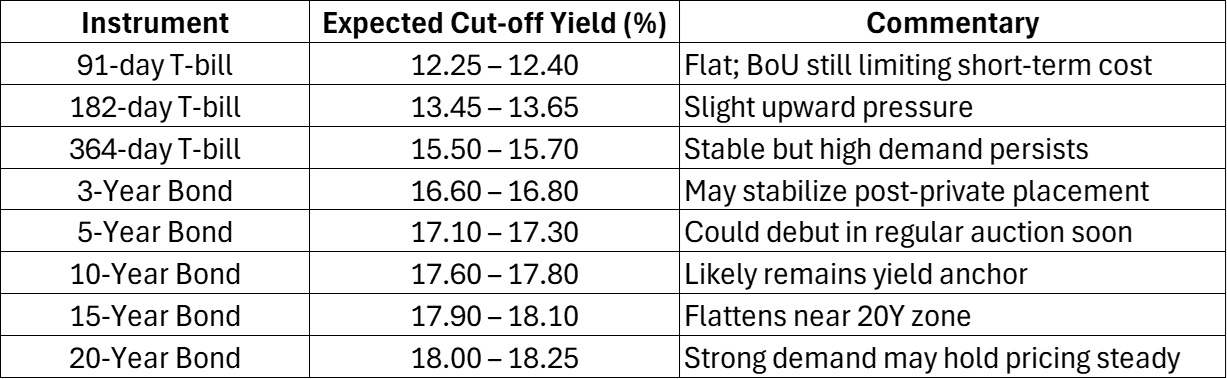

June 2025 Yield Forecast – Upcoming Auctions

The yield forecast for Uganda’s upcoming Treasury auctions in June 2025 is based on a combination of macroeconomic signals, market behavior, and central bank policy posture.

Here's a breakdown of the key factors informing our forecast:

Basis

Cut-off yields have consistently risen across all tenors, particularly in the 10–20 year range.

Strong bid-to-cover ratios (often 2.0x or higher on longer maturities) show continued demand, even at elevated rates.

364-day T-bill demand remains robust, with BoU accepting the bulk of funds here — an anchor for short-term rate forecasts.

The UGX 2.4 trillion private placement in late May may reduce the need for aggressive issuance in June.

The resumption of World Bank lending eases near-term pressure on domestic borrowing.

BoU has recently rejected most short-term bids (91d & 182d), signaling a desire to manage short-end cost tightly.

Meanwhile, it’s been more accommodative on 10Y+ issuance, often accepting large amounts when demand is strong and yields are “reasonable.”

Institutional investors (e.g., NSSF, PDs) are seeking duration and yield stability, supporting longer-dated securities.

There’s a tactical shift toward laddering between 1-year T-bills and 10Y bonds.

Impala Market View - June Auction Outlook

Expect moderate downward yield pressure if World Bank disbursements begin soon.

Watch BoU behavior closely - they may cap long-term yields to manage future debt service.

Retail/institutional investors should target:

1-year T-bills for safe, high-yield cash management

10Y bonds for portfolio core exposure

20Y bonds if yield >18% is offered again

🚀 Not yet a subscriber? Join Impala Market Premium for weekly strategy, positioning maps, and alpha signals.

Want to invest in Africa’s bond markets? Impala Market helps you track opportunities, compare bond yields, and connect with buyers & sellers in the Over the Counter (OTC) market.

Get real-time bond market insights, track upcoming auctions, and access the secondary (OTC) market to trade bonds effortlessly.

Weekly insights on bond market developments, macro drivers & investment opportunities

Tailored for individual investors, investment clubs, institutional investors, traders & offshore investors

Subscribe for updates on Impala Market

Disclaimer: Impala Market is a private information-sharing platform for licensed institutions. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.