A Beginner's Guide to Investing in Treasury Bonds & Bills (Ethiopia Edition)

Impala Market, Your trusted guide to Africa’s fixed income markets

Introduction

Investing in government bonds and treasury bills is one of the safest ways to grow your money in Ethiopia. Whether you're an individual saver, part of an investment club, or simply looking for low-risk returns, this guide breaks it all down in simple steps.

We'll walk you through what government securities are, how to buy and sell them, how they earn you money, and how to start investing right here in Ethiopia. No financial background needed; just curiosity and a bit of patience.

Step 1: What Are Government Bonds & Bills?

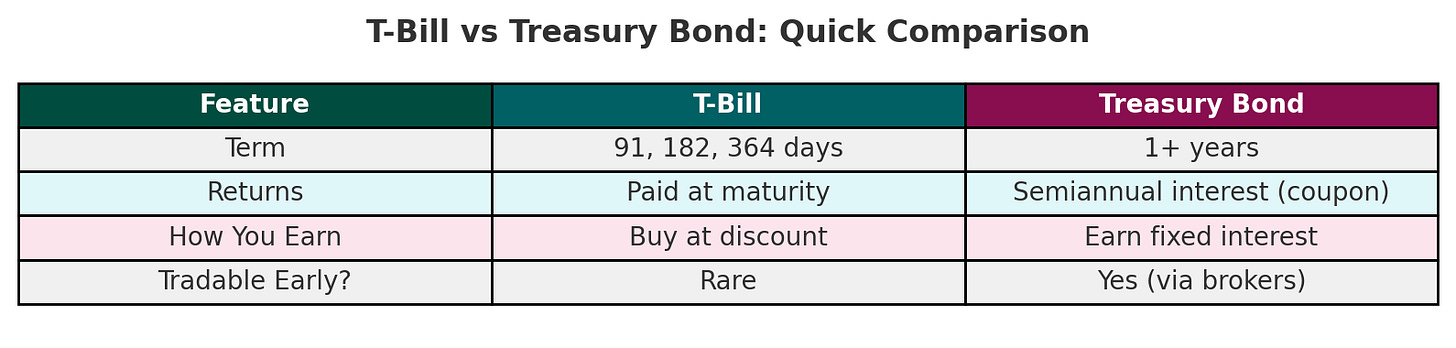

Treasury Bills (T-Bills):

Short-term investments (91, 182, or 364 days).

You buy them at a discount and get full value at maturity.

No regular interest payments; just a guaranteed return.

Treasury Bonds:

Longer-term investments (1 year or more; some go up to 10+ years).

Pay interest (called a "coupon") every 6 months.

Can be sold before maturity through brokers (secondary market).

Why They're Safe:

You're lending money to the government, and it's backed by law. While returns are usually lower than risky investments, the chance of losing your money is also much lower.

Step 2: How to Get Started in Ethiopia

Can retail investors participate?

Yes! Starting in 2024, key reforms have opened access to more than just banks and pension funds. Treasury bills and bonds are gradually becoming available to institutions, companies, and, soon, retail investors like you. While the retail segment is still in early development, these changes, paired with major institutional activity, suggest that wider public participation is just around the corner.

In March 2025, Ethiopian Investment Holdings (EIH) made headlines by investing nearly 7 billion birr (roughly USD 51.5 million at ETB 136/USD) in treasury bills, a bold signal that government securities are gaining traction beyond traditional banks and pension funds.

This move reflects a shifting landscape:

The National Bank of Ethiopia (NBE) and the Ethiopian Capital markets Authority (ECMA) have introduced regulatory frameworks that pave the way for institutions, companies, and eventually retail investors to directly access government securities.

The Ethiopian Central Securities Depository (CSD) system is expanding to include more market participants, and a fully digital onboarding platform is gradually rolling out via partner banks.

How to Open a CDS Account:

In the very near future, individuals are expected to:

Open a CDS account through participating banks or brokers.

Use that account to bid in treasury auctions via mobile or online portals.

Access real-time bond market prices via brokers and the OTC (over-the-counter) market.

This ecosystem is still taking shape, but Ethiopia is clearly preparing to open the door for wider public investment in its domestic debt market, making this the ideal moment to start learning, planning, and positioning for early participation.

Where Bonds Are Bought:

Primary market: directly from the government through auctions.

Secondary market: from other investors, via brokers (Over-the-Counter or OTC).

Step 3: How You Make Money

For T-Bills:

Example: You buy a 100,000 ETB T-Bill for 91,000 ETB.

After 91 days, you get 100,000 ETB back.

Your return: 9,000 ETB (without any interest payment, as the T-Bill was bought at a discount).

For Bonds:

You earn a fixed interest payment also known as a coupon payment (say 10%) paid every 6 months.

You get paid your full principal back at the end of the bond term.

You can sell before maturity if you need to cash out early (market conditions apply).

Important Terms:

Coupon Rate = Annual interest paid.

Maturity = When the bond ends and full amount is returned.

Discount = When you buy a T-Bill for less than its value.

Step 4: Comparing with Other Options

How do bonds stack up against other savings or investment tools?

Insight: Government securities are best for people who want stable returns, peace of mind, and low risk.

Step 5: Your Next Steps

Talk to your bank about opening a CDS account.

Ask when the next auction is happening (usually weekly for T-bills).

Start small; even 5,000 ETB is enough to begin.

Follow Impala Market for weekly updates on yields, auction results, and bond news.

Final Thoughts

Ethiopia is quietly building a more open and accessible bond market. With tools like the Capital Market Proclamation and the launch of ECMA and NBE's auction reforms, there’s never been a better time to learn.

This is your chance to be early, to learn how to grow your savings safely while supporting the national economy.

👉 Want weekly updates and new investor guides? Subscribe to Impala Market

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Impala Market is a private information-sharing platform. It is not a licensed securities exchange or trading platform. Indicative prices shared are not offers to the public.